The outlook for financial markets remains as uncertain as ever while they navigate a post-election environment that affects the easing of interest rates, employment (i.e. labor supply & demand), and investors’ earnings expectations. Yet, amid this uncertainty, public entity insurers must generate sufficient, predictable investment income to support underwriting results.

For many public entity insurers, such as government risk pools, joint powers authorities, self-insurers, captives, etc., that means an investment portfolio already hamstrung by asset class restrictions – typically limited to US Treasuries and Agencies – faces even further pressures and potential volatility.

Even for public entity insurers that are allowed to invest in a greater scope of investment-grade bonds or have the flexibility to invest in risk assets (i.e. equities, bank loans, high-yield bonds, etc.), it will be a difficult time to assess the benefits of short-term changes versus the long-term horizon intended for public entities.

With such an uncertain outlook on the horizon, public entity insurers must invest prudently. But what should they do?

First, public entity insurers should be sure to focus on the overall investment process.

Start with the basics, which are surprisingly little followed all of the time.

Markets go up, down, and sideways, and, many times, surprise the so-called experts. However, what doesn’t change is that what is most important is making investment decisions that are correct for your entity, irrespective of what you may see, hear, read or smell about financial markets.

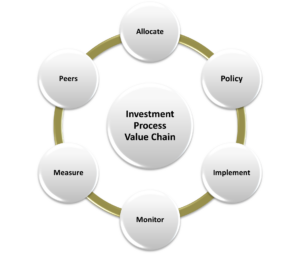

Investment basics revolve around the “Investment Process Value Chain,” which encompasses the six most important parts of a public entity’s investment process.

Why focus on process? A good process should produce good results over the long term.

To illustrate, if poor results ensue from a good process, such outcomes would be considered bad luck. Meanwhile, it is possible to get good results from a bad process. That, too, would be luck. But, this time, it would be good luck, since you would expect poor results to come from a bad process.

Many investors focus solely on the results. “Just give me the bottom line. Did we beat our benchmarks or not? Are we getting the yield we need or not?” These are worthy sentiments, but besides there being better questions to ask than those, they do not focus on the process.

Here’s a simple explanation of the “Investment Process Value Chain” and how, if focused on an improved investment process, public entity insurers can manage much of the financial market uncertainty over the long term.

1. Investment Policy – These can be anywhere from two-page policies to near handbook-length documents. However, a ‘best practices’ policy has five important sections. And what may be the most important section is the one the I see missing all too often: Corporate Governance - Who is responsible for what, when, and how?

This is also not a static process; new investment alternatives, changing regulatory environments, and evolving operating conditions mean that reviews should typically be conducted annually.

2. Strategic Asset Allocation – This goes hand in hand with the policy since the results of a comprehensive asset allocation analysis – one that considers assets, reserves, capital, income, different interest rates and economic scenarios, etc. – will ultimately determine most of the total return a public entity will receive.

3. Investment Manager Evaluation and Selection – Most public entity insurers will utilize an external investment manager to manage the portfolio. What is key is keeping their performance, adherence to the entity’s goals and objectives, and any material firm changes top-of-mind. A disciplined approach to manager evaluation and selection that takes into account the manager’s investment process, philosophy, people, and systems is a good starting point

4. Portfolio Monitoring – Since most public entity insurers don’t have a Chief Investment Officer (or similar position) on staff, most will meet with their investment manager quarterly and have little communication with the manager intra-quarter, unless something unusual or unexpected occurs. However, it is usually better to anticipate and monitor potential areas for discussion rather than awaiting those end-of-quarter communications. Discussions would include analyzing expected credit losses, assuming investments are being made outside US government-related bonds, and stress testing the portfolio for potential ‘black swan’ type events. Anticipating changing risks before they may occur becomes part and parcel of portfolio monitoring.

5. Performance Measurement – This is an area most public entity insurers would say is handled quite well given monthly/quarterly reporting. However, it is important that public entities also review metrics like risk-adjusted performance (since there is no return without some risk)? Does the public entity know how the manager’s performance compares to various other similar investment managers? Importantly, there are many other ways to view performance measurements, including monitoring how your public entity insurer is progressing in improving the overall investment process.

6. Peer Group Analysis – While not always easy to conduct, it can be helpful to gauge how the portfolio may compare to others. While more holistic in nature, peer group analysis can prompt key questions such as, “Why do you think are they doing that?” “Is this a strategy we should consider? Why? Why not?”

While the financial markets and operational expectations will certainly fluctuate over time, a better understanding of the overall investment process can prompt public entity insurers to take an overall, detailed look at how the investment portfolio is tied to its organizational goals and objectives. This, in turn, helps improve the chances of achieving positive investment results even during uncertain times.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Alton Cogert

President & CEO, Strategic Asset Alliance

Summary of Qualifications

Mr. Cogert formed Strategic Asset Alliance in 1994, an investment consulting firm that only works with commercial insurance companies and public entity insurers, such as risk pools, JPAs, self-insurers, captives, etc.

Mr. Cogert is an Independent Member of American Fidelity Assurance Company's Investment Committee of the Board. He previously served as a technical advisor to the NAIC Invested Assets Working Group. He is a former member of the Board of Directors and former chairman of the Investment Committee of the National Alliance of Life Companies.

Responsibilities

In addition to acting as an investment advisor to public entity insurers, commercial insurers, risk pools, captives, etc., Mr. Cogert leads the firm as its President & CEO.

Business Experience

Prior to SAA, Mr. Cogert accumulated more than 20 years of financial institution experience, including over 10 years experience in senior financial management.

Professional Affiliations

He is a Chartered Financial Analyst, a Certified Public Accountant, Chartered Alternative Investment Analyst and a Financial Data Professional Charterholder.

Education

Mr. Cogert holds a BS from the Wharton School of the University of Pennsylvania and an MBA from the University of Southern California.