The very elusive EMOD…what does it mean and how can you control it?

If you’re new to the risk management world, or part of a pool, you may not have heard the term EMOD; but, if your organization is self-insured, you probably have. Let’s start with the definition. Your organization’s EMOD is an experience modification rate comparing your organization to its peers and using a calculation of actual losses incurred over expected losses. What you really need to understand is how it impacts your workers’ compensation premium.

- “1” is considered “average.” The closer you are to “1,” the better off your organization is.

- Under “1,” even better.

- Waaay under “1,” you’re golden.

- Over “1,” you’ve got a problem that you should be paying attention to and putting a considerable amount of time and effort into resolving. This will take time. You didn’t get here overnight so you’re not going to bounce back overnight. But, changing the trajectory of your EMOD rate could literally save you thousands of dollars by giving you leverage and negotiating power.

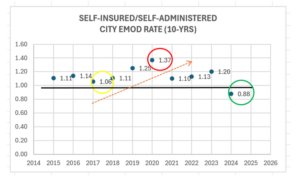

Based on what I’ve just described, what can you determine from the chart below?

Correct! THIS. WAS. NOT. GOOD! What you should recognize is that this organization had never been under “1.” The best year this organization had was in 2017. Followed shortly thereafter with an all-time high in 2020. So, what does that mean for the bottom line? It means that in addition to “normal” market volatility and other factors taken into account by underwriters when procuring insurance policies, it is likely that the premium assessed during the peak year was 37% higher than another entity whose EMOD was sitting at “1.” Crazy, right? Let me say that again, 37% more than a peer for the same (or better) coverage.

So, what can the risk management team (work comp and/or safety) do about this?

- KNOW YOUR CLAIMS. Even if you have a TPA, review your claims on a regular basis.

- COUNT PROPERLY. That means, make sure you aren’t counting things you shouldn’t (e.g. incidents that aren’t work-related) and your employee and volunteer hours are correct.

- CREATE POLICY. Specifically focused on reporting incidents. Make sure employees report everything immediately (and that means no later than the end of the shift).

- INVESTIGATE. Investigate every single injury. You can learn a lot by asking the right questions of the right people.

- DEVELOP A COMPREHENSIVE RTW PROGRAM. Don’t let an employee tell a doctor, “They don’t have light duty for me.” The employee may actually believe that, but if you have a program in place that actively seeks light duty assignments anywhere in the organization, especially now with remote or hybrid work opportunities, it’s even easier than it was 5-10 years ago. There is always work that needs to be done.

- RESERVE ACCURATELY. Look at: life expectancy, rated age, claim development, all anticipated events.

- Always consider full and final settlements.

It’s your story to tell, tell it well.

Maria Robinson

Risk Manager, City of Tucson, AZ

Author Biography

Maria has nearly 20 years of experience in the risk management industry, over 25 years in the public sector, and has previously served as the loss prevention and safety manager for the City of Tucson and the occupational medical manager for Pima County, both in Southern Arizona. Maria draws upon her experience to build relationships, offer mission-oriented solutions, and help others get to “yes” whenever possible. She is described by her organization as “invaluable” to the team.

Maria earned a BSBA from the University of Arizona’s Eller College of Management, a Master of Legal Studies in compliance and legal risk management from the University of Arizona James E. Rogers College of Law and holds a Professional Certificate in Occupational Safety and Health from UCSD. Public speaking engagements include AZ SWANA, ADEQ, Southern AZ NSC and ADOSH. Maria is a Certified OSHA outreach instructor, a Registered Safety Professional (RSP), holds a Black Belt Certification in Lean Sigma and has obtained her Fire Inspector I Certification. She is also a board member with AZPRIMA and a member of ASSP.