Through articles, presentations and news reports, you’ve probably heard about automakers developing and testing vehicles that require little or no human driver interaction. These highly automated vehicles, or HAV, will create a new paradigm in vehicle use, safety and insurance.

Realistically though, given the number of new automobiles sold annually and the industry’s manufacturing capacity, a total turnover to driverless cars is decades away.

Requisites for HAV to be effective

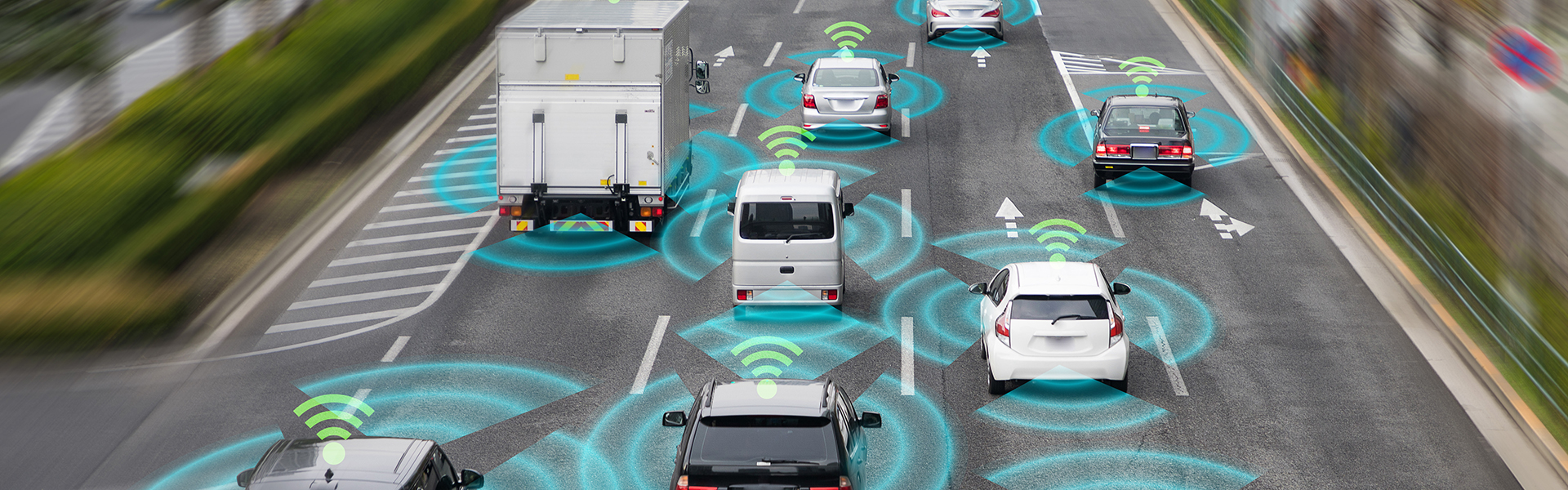

Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I) technologies are requisites for the effective deployment of HAV. V2V involves the wireless transmission of data between motor vehicles, while V2I wirelessly connects motor vehicles to public infrastructure such as traffic lights and roadways.

If manufacturers and government entities can reach consensus on regulatory objectives and communications standards for these two technologies, they will likely be deployed more quickly than HAV.

How this can reduce a large number of accidents

The U.S. Department of Transportation estimates that V2V technology could reduce unimpaired driver accidents by as much as 80 percent and that V2I adds an additional 12 percent reduction in unimpaired driver accidents.

The advantage of speeding up deployment of V2V technology

One advantage in ramping up deployment of V2V technology versus HAV is that V2V can be installed after-market in existing vehicles at relatively low cost. Data tracked by V2V can include a vehicle’s position, speed, direction, braking and steering and can be communicated using visual cues, tones or vibration. Sharing this data with other drivers could prevent accidents caused by emergency braking, unsafe passing and confusion at intersections regarding right-of-way.

A motor vehicle communicating with infrastructure may increase compliance of traffic laws, improve traffic flows and reduce emissions from idling times. So, beyond safety, these technologies could also benefit road mobility and the environment.

New technologies will present new opportunities

Public entities will also see the benefits of V2V and V2I. These technologies can help expedite emergency vehicle responses, assign police to the highest priority crimes first and provide data for smart city planning.

New technologies will present new challenges

As with any innovation, the resulting change will present potential difficulties. A large majority of police stops are the result of traffic violations, meaning significant workload decreases may require difficult staffing decisions. Revenue from traffic fines will likely also decrease, affecting city budgets.

In addition, public entities must weigh the upgrade cost of smart infrastructure during their budgeting processes. This will require using complex calculations for the cost/benefit trade-offs in construction, staffing, maintenance and safety.

Other areas of concern cities should consider

V2V and V2I implementation could bring other daunting challenges regarding communication security, privacy concerns, platform standardization and critical mass of deployment

Even so, dozens of forward-looking communities are already using available federal grants, public/private partnerships and technology incubators to evaluate the impact of these exciting technologies.

Considering the potential for saving thousands of lives annually, this discussion should be on every community’s agenda.

By: Thom Rickert, CPCU, ARM, ARM-P, ARM-E, ARC, ARe

Emerging Risk Specialist, Argo Group

Summary of Qualifications

Thom has enjoyed a 37-year career in the insurance industry and is currently with Argo Group U.S. as an emerging risk specialist. Rickert has extensive underwriting and marketing experience in all property and casualty lines of business, spanning multiple segments and industries. He has been responsible for implementing corporate compliance and efficiency projects and has served as a business leader for technology solutions in policy administration, underwriting, channel management, and business development analytics.

Responsibilities

As an emerging risk specialist, Rickert extends his view to trends influencing the future of risk and insurance. He is also responsible for building and cultivating a high-performance marketing discipline that creates value and relevance in the public sector marketplace. In this role, Rickert is actively involved with shaping Trident Public Risk Solutions', an Argo Group company, business strategies, growth action plan, product development and enhancement, as well as distribution channel management.

Business Experience

Over a 35 year insurance career, Thom has held various staff and management positions in underwriting, marketing, sales, systems administration and training & education for U.S. and internationally domiciled commercial insurance carriers and brokers. He has also served as president and chief operating officer of an independent commercial lines insurance agency.

ERM Experience

Thom holds The Institutes' Associate in Risk Management - Enterprise-wide Risk Management (ARM-E) designation. He currently acts as the enterprise risk management focal point for his business unit. Thom supports the business in ensuring that risk management is integrated into the function of the unit and that the threat and opportunity risk and control profile is accurately captured and positively managed on an ongoing basis.

Professional Affiliations

Public Risk Management Association (PRIMA), Risk Management Society (RIMS), Governmental Finance Officers Association (GFOA), Association of Governmental Risk Pools (AGRiP)

Education

Trinity University (San Antonio, TX) - BA - Philosophy and History

Chartered Property Casualty Underwriter (CPCU)

Associate in Risk Management (ARM), Associate in Risk Management – Public Entities (ARM-P), Associate in Risk Management – Enterprise-Wide Risk Management (ARM-E)

Associate in Insurance Regulation and Compliance

Associate in Reinsurance

SIX SIGMA – Green Belt Certified