January 22, 2025 | 12:00 p.m. – 1:00 p.m. ET

Join us for an insightful webinar exploring the emerging trends shaping the property and casualty insurance landscape for the public sector. This session will cover critical topics, which could include rising property risks due to climate change, evolving liability exposures and the growing importance of comprehensive cyber coverage amidst increasing ransomware and data breach threats. We'll discuss emerging challenges such as crisis response planning for catastrophic events, specialized coverage needs for law enforcement and addressing sensitive issues like sexual abuse claims with effective risk management strategies. Attendees will gain valuable insights into navigating these complexities, with a focus on proactive solutions to safeguard public entities and their communities. Don't miss this opportunity to stay ahead of the curve in managing public sector risks.

Attendee Takeaways:

1. Gain insight into how climate change, cyber threats and societal trends are reshaping the market

2. Learn actionable steps to address critical issues

3. Explore best practices for balancing affordability and protection

4. Discover how advancements in technology, such as AI, are transforming

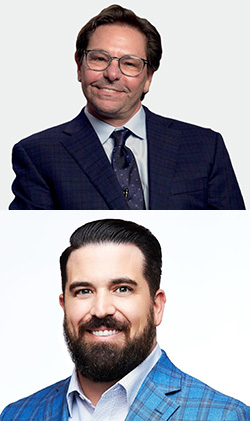

Presenters

John Chino, ARM-E, ARM-P, CSRM, Area Senior Vice President, Arthur J. Gallagher

Marcus Henthorn, National Sales Leader, Risk Program Administrators

John works with clients to establish goals, strategies, marketing and renewal activities. He participates in renewal meetings, and other meetings as may be necessary, coordinates the completion of actuarial studies, and assists with contract language, coverage agreements and other documents. John’s areas of expertise include public entity property & casualty insurance brokerage, policy design/manuscript, market trends/strategy, self-insurance approaches, owner-controlled insurance programs (OCIP) and education/training specialist. John has been in the insurance industry since he joined Gallagher in 1981. He delves into public entity, scholastic and higher education accounts. He has developed 18 self-insurance pools/trusts and created eight coverage documents during his career. John completed a two-year internship at Lloyd’s of London specializing in the placement of self-insured public entity programs before joining Gallagher.

Marcus is the national sales director for Risk Program Administrators (RPA), where he is responsible for providing strategic guidance, industry expertise and custom services to advance public and private entity risk pools and programs. He also serves as the managing director of Gallagher’s Public Sector & K-12 Education practice where he is responsible for developing and executing business strategies for Gallagher's largest and most dominant practice groups comprised of 500+ employees, 18,000+ clients and over $2B in premium. Marcus enjoys nothing more than the challenge of providing risk management and administration expertise to some of the largest and most complex public entity programs in the United States. Throughout his career at Gallagher, he has worked in multiple offices, including Lloyd’s of London, and he is based out of the company's global headquarters. He has received several Risk & Insurance Power Broker and Rising Star awards, the Business Insurance Americas Top Producer, and the Business Insurance Break Out Award over the course of his career.