In today’s public school environment, both students and staff are constantly on the alert for unauthorized persons on campus. Children, in particular, are often taught to announce the presence of unknown third-parties with the familiar cry of “stranger danger!” But what about those persons (other than parents or guardians) who are temporarily invited to be on school property?

Such persons or invitees are defined by most courts to mean “A person who enters land with permission of the owner, and does so either to confer an economic benefit on the possessor.” The people who most commonly fall into the invitee category are third-party contractors or vendors who are invited to campus to perform certain construction or maintenance duties. For the purposes of this piece, the term “invitee” shall be used, and is intended to refer to both contractors and vendors.

Because invitees have access to children, they potentially pose a risk for sexual misconduct allegations. Risk managers should ensure a policy is in place that serves to alert her or him to the presence of third-party invitees as well as all situations in which invitees may or will have access to students. Further, each of the invitee’s employees, representatives and volunteers need to comply with both the school’s and respective state’s background check requirements. Procedures should also be in place to ensure that invitees are never permitted to be alone with children.

Along with the above, risk managers must warrant that school administrators routinely require invitees to acknowledge that they have received and read the school’s relevant child protection policies. It is imperative for invitees to be required to self-report to the school any issues related to inappropriate interactions between their employees, etc., or other disciplinary issues involving their employees’ work with the school. Additionally, they should be required to fully cooperate and share pertinent information if the school needs to conduct an investigation involving an employee’s actions. Any violation or suspected violation of the school’s child protection-related policies should constitute grounds for terminating the contract with the invitee and result in a formal ban from bidding on all future contracts.

Currently, there appears to be a trend amongst some courts to look askance at indemnification and hold harmless clauses in vendor contracts. Nevertheless, the invitee should be required to carry primary and excess insurance coverage for acts of sexual abuse or molestation committed by its representatives, employees or volunteers in an amount of at least $1 million per occurrence with a $2 million aggregate amount for the policy period. The invitee should also be mandated to provide the school with a certificate of insurance demonstrating its sexual abuse and molestation coverage, and the school should be named as an additional insured on the invitee’s general liability policy or, if written as a separate coverage, on the sexual abuse and molestation policy. Of course, the savvy risk manager will accomplish the above in concert with the school’s attorney. In summary, the risk manager must be considered an integral player when it comes to the presence of third parties on campus.

By: Joe Jarret

Attorney/Risk Management Advisor, University of Tennessee

Summary of Qualifications

Joe Jarret is an attorney, federal & state mediator and a former public risk manager who has been practicing public sector law and management for over 27 years. He has served three different public entities as chief legal counsel/managing attorney. He currently teaches risk and emergency management on behalf of the University of Tennessee’s Masters in Public Policy & Administration Program. Joe is the past-president of the Southwest Florida Chapter of PRIMA, and National PRIMA’s 2016 “Author of the Year,” with his piece on Zoning & Planning Risk being named “Article of the Year.”

Responsibilities

Joe is responsible for the education and training of the next generation of risk and emergency management professionals. Responsible for creating department budget and for managing general liability, labor and employment, land use/planning and related litigation and transactional matters, negotiating, litigating or settling all-lines claims; creating risk, and emergency management policies and procedures.

Business Experience

Joe has been a chief legal counsel/managing attorney for three different public entities. He is licensed to practice law before the United States Supreme Court, the Tennessee Supreme Court and all lower state courts, as well as Federal Court. His business experience also includes recruiting, hiring, training, evaluating, disciplining and dismissing employees.

ERM Experience

During his service as a risk manager and managing attorney, Joe was expected to understand, control and articulate the nature and level of risks taken in pursuit of public business strategies as well as remain accountable for risks taken and activities engaged in.

Professional Affiliations

East Tennessee Chapter of PRIMA, Tennessee Bar Association, International City/County Managers Association, American Society for Public Administration, Tennessee City Managers Association, Knoxville Bar Association, Tennessee Valley Mediation Association

Education

Joe holds a Bachelor of Science Degree, a Masters in Public Administration degree, a Juris Doctorate degree, a Graduate Certificate in Public Management and is a candidate for the Ph.D. in Educational Leadership

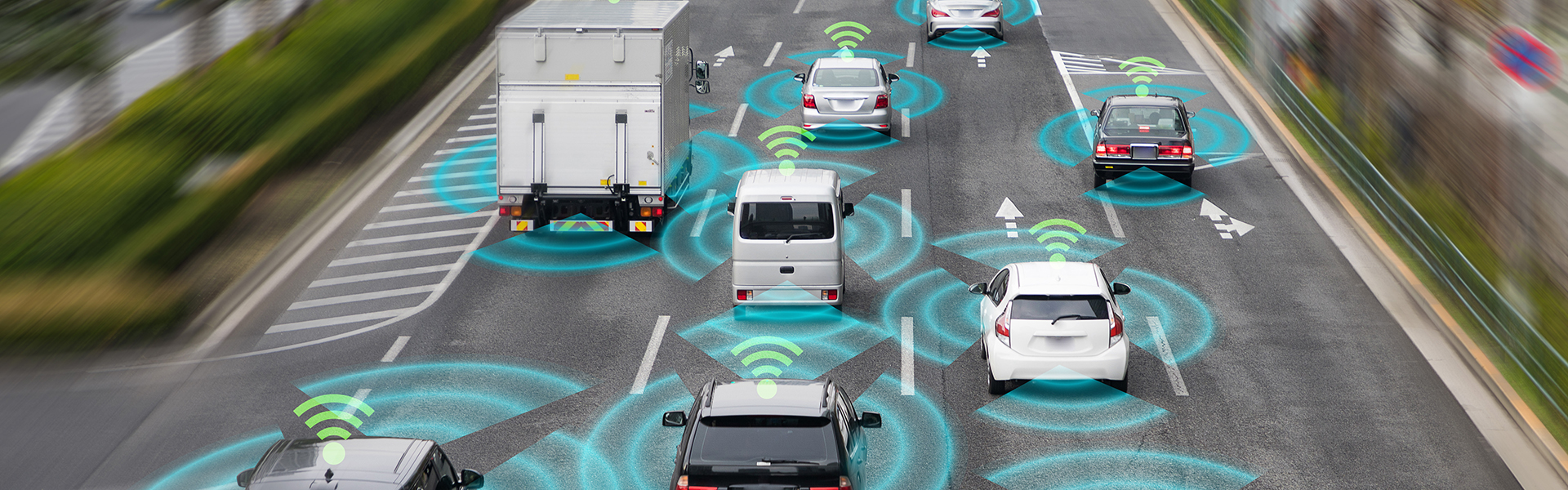

Through articles, presentations and news reports, you’ve probably heard about automakers developing and testing vehicles that require little or no human driver interaction. These highly automated vehicles, or HAV, will create a new paradigm in vehicle use, safety and insurance.

Realistically though, given the number of new automobiles sold annually and the industry’s manufacturing capacity, a total turnover to driverless cars is decades away.

Requisites for HAV to be effective

Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I) technologies are requisites for the effective deployment of HAV. V2V involves the wireless transmission of data between motor vehicles, while V2I wirelessly connects motor vehicles to public infrastructure such as traffic lights and roadways.

If manufacturers and government entities can reach consensus on regulatory objectives and communications standards for these two technologies, they will likely be deployed more quickly than HAV.

How this can reduce a large number of accidents

The U.S. Department of Transportation estimates that V2V technology could reduce unimpaired driver accidents by as much as 80 percent and that V2I adds an additional 12 percent reduction in unimpaired driver accidents.

The advantage of speeding up deployment of V2V technology

One advantage in ramping up deployment of V2V technology versus HAV is that V2V can be installed after-market in existing vehicles at relatively low cost. Data tracked by V2V can include a vehicle’s position, speed, direction, braking and steering and can be communicated using visual cues, tones or vibration. Sharing this data with other drivers could prevent accidents caused by emergency braking, unsafe passing and confusion at intersections regarding right-of-way.

A motor vehicle communicating with infrastructure may increase compliance of traffic laws, improve traffic flows and reduce emissions from idling times. So, beyond safety, these technologies could also benefit road mobility and the environment.

New technologies will present new opportunities

Public entities will also see the benefits of V2V and V2I. These technologies can help expedite emergency vehicle responses, assign police to the highest priority crimes first and provide data for smart city planning.

New technologies will present new challenges

As with any innovation, the resulting change will present potential difficulties. A large majority of police stops are the result of traffic violations, meaning significant workload decreases may require difficult staffing decisions. Revenue from traffic fines will likely also decrease, affecting city budgets.

In addition, public entities must weigh the upgrade cost of smart infrastructure during their budgeting processes. This will require using complex calculations for the cost/benefit trade-offs in construction, staffing, maintenance and safety.

Other areas of concern cities should consider

V2V and V2I implementation could bring other daunting challenges regarding communication security, privacy concerns, platform standardization and critical mass of deployment

Even so, dozens of forward-looking communities are already using available federal grants, public/private partnerships and technology incubators to evaluate the impact of these exciting technologies.

Considering the potential for saving thousands of lives annually, this discussion should be on every community’s agenda.

By: Thom Rickert, CPCU, ARM, ARM-P, ARM-E, ARC, ARe

Emerging Risk Specialist, Argo Group

Summary of Qualifications

Thom has enjoyed a 37-year career in the insurance industry and is currently with Argo Group U.S. as an emerging risk specialist. Rickert has extensive underwriting and marketing experience in all property and casualty lines of business, spanning multiple segments and industries. He has been responsible for implementing corporate compliance and efficiency projects and has served as a business leader for technology solutions in policy administration, underwriting, channel management, and business development analytics.

Responsibilities

As an emerging risk specialist, Rickert extends his view to trends influencing the future of risk and insurance. He is also responsible for building and cultivating a high-performance marketing discipline that creates value and relevance in the public sector marketplace. In this role, Rickert is actively involved with shaping Trident Public Risk Solutions', an Argo Group company, business strategies, growth action plan, product development and enhancement, as well as distribution channel management.

Business Experience

Over a 35 year insurance career, Thom has held various staff and management positions in underwriting, marketing, sales, systems administration and training & education for U.S. and internationally domiciled commercial insurance carriers and brokers. He has also served as president and chief operating officer of an independent commercial lines insurance agency.

ERM Experience

Thom holds The Institutes' Associate in Risk Management - Enterprise-wide Risk Management (ARM-E) designation. He currently acts as the enterprise risk management focal point for his business unit. Thom supports the business in ensuring that risk management is integrated into the function of the unit and that the threat and opportunity risk and control profile is accurately captured and positively managed on an ongoing basis.

Professional Affiliations

Public Risk Management Association (PRIMA), Risk Management Society (RIMS), Governmental Finance Officers Association (GFOA), Association of Governmental Risk Pools (AGRiP)

Education

Trinity University (San Antonio, TX) - BA - Philosophy and History

Chartered Property Casualty Underwriter (CPCU)

Associate in Risk Management (ARM), Associate in Risk Management – Public Entities (ARM-P), Associate in Risk Management – Enterprise-Wide Risk Management (ARM-E)

Associate in Insurance Regulation and Compliance

Associate in Reinsurance

SIX SIGMA – Green Belt Certified

“The man who makes no mistakes does not usually make anything.”

Inspiring words from Edward J. Phelps, and certainly in some aspects of life, mistakes need to be made in order to learn and grow. Unfortunately, in the increasingly digitized world in which we live, when people make mistakes online, the things they create are usually very messy and very costly.

Employees play a large role in the state of your organization’s cybersecurity. Here are some tips to help you refine your strategy:

Employee Training

Odds are you have an army of defenses against external threats, such as malware, network attacks, viruses and phishing scams. These walls can be easily scaled if your employees aren’t aligned with your cybersecurity strategies. Did you send a company-wide memo on security? Great. But as we all know, standard policies are often times skimmed through and easy to overlook.

To really capture the attention of your workers and educate them on the nuances of the latest security threats, organizations should be offering frequent and interactive training sessions. According to the Ponemon Institute, employee training is the third-most effective method of decreasing the per capita cost of a breach.

As with shampoo and conditioner, rinse and repeat is the recommended best practice for employee training. A single session is not going to arm your employees with the tools they need to keep up with the constant change in security threats.

Identify and Intervene with High-Risk Users

My mother has a list of passwords for a wide variety of websites she uses taped to her computer monitor because it’s convenient. While risky behavior like that is difficult to detect with analytics software, there are tools available to help organizations identify many common indicators of negligent or malicious activity, including:

- Inappropriately creating, sending or storing sensitive data

- Accessing, deleting or moving a large amount of sensitive content

- Emails and messages that contain extremely negative sentiment against the company

While taking advantage of these types of technologies to close the risk gap against cyber threats, companies need to pay close attention to the issue of privacy, which can create a new set of challenges if not managed correctly.

By: Jim Nulsen

Vice President of Strategic Partnerships, Vector Solutions

Summary of Qualifications

Jim is vice president of strategic partnerships with Vector Solutions Education, a leader in eLearning and performance support that serves the education market through its SafeSchools, SafeColleges, Exceptional Child and TeachPoint product portfolio. During his 13-year tenure, Nulsen has led the sales and marketing efforts through initial stages of growth.

Responsibilities

The Strategic Partnerships division of Vector Solutions is responsible for creating and developing strategic alliances, fostering new business development opportunities, and building a global partnership program.

Business Experience

Jim works closely with insurance and risk organizations to successfully implement web-based safety, compliance and risk prevention programs for policyholders. Driving utilization of online training, incident reporting and chemical management programs has been vital to helping partners retain and grow business.

Professional Affiliations

Madeira Schools Foundation (Trustee)

Education

Miami University, B.A.

Every day the media reports on new stories involving children harmed by bullying, in both big and small ways. Any institution that provides programs for children (e.g. schools, day camps, park districts, recreation departments) faces the potential that bullying may occur on its watch and the risk that it may be held responsible for the impact of that behavior, or, at a minimum, be required to defend itself against allegations that it should have done more. If this responsibility is not lived up to it can result in significant attorney’s fees, settlement payments and other expenses as a result of a lawsuit filed by or on behalf of a bullied minor.

Federal anti-discrimination laws impose an obligation on schools to intervene and stop bullying that rises to the level of harassment. This obligation arises whenever harassment as a result of a student’s race, color, national origin, sex or disability deprives that student of the educational benefit of attending school. Typically, an institution will not be liable for an initial act of harassment. However, once it is known that harassment has occurred, the organization must intervene to prevent further harassment.

State laws often impose even greater and more demanding obligations on schools and other organizations that work with minors. All fifty states have enacted anti-bullying legislation. The definition of bullying used in these state laws can be much broader than the harassment addressed by federal law. For example, Illinois prohibits bullying related to a lengthy list of characteristics, such as ancestry, sexual orientation and gender identity or expression (whether these are “actual or perceived characteristics”) and also prohibits bullying based on “any other distinguishing characteristic.” The law also applies to bullying of a person based on their association with a person or group with such characteristics.

Many states impose an affirmative duty on schools to protect their students from bullying. Some require schools to adopt an anti-bullying policy. States may even dictate some of the provisions of a school’s anti-bullying policy. In some states, the strictness of these requirements can be limited by or balanced against tort immunity laws that make it more difficult for a victim of bullying to bring a private lawsuit against an educational institution than against other parties, such as a private citizen or a for-profit corporation. Those limitations, though, may still allow for suits against teachers, principals, administrators and other institutional leaders.

In an effort to satisfy these responsibilities, schools and other organizations can also inadvertently impose even more demanding obligations on themselves if they enact an anti-bullying policy that is too strict and/or too specific. An organization that drafts a policy that is stricter than what is required by law can be held liable for not adhering to the tougher standard they set for themselves. An organization can also be held liable if it drafts a policy that is more specific than necessary when stating the steps that must be taken in response to bullying and fails to adhere to those steps, even if its response was reasonable and responsible.

Moreover, schools and other organizations that work with minors need to be aware that much bullying behavior takes place on social media or through means of electronic communication. Kids who engage in bullying purposefully attempt to hide their actions from authority figures, whether they are acting in-person or by taking their behavior online. Schools and other institutions must be prepared to respond to both traditional bullying and the developing problem of cyber-bullying. They can be obligated to respond to cyber-bullying even if it is committed by a minor using an off-site computer that is not owned or in the possession of the organization.

Adequately preparing to prevent and respond to bullying is a challenging task that is made more complex because of the variation in state laws regarding this issue, but your school or organization must be equipped for the challenge. The well-being of the minors you work with depends on it. So does the well-being of your organization.

By: Ryan Larson

Kopon Airdo, LLC

Summary of Qualifications

Ryan was admitted to practice law in Illinois in 2013 and with the U.S. District Court, Northern District of Indiana, in 2017.

Responsibilities

Ryan's practice focuses primarily on not-for-profit and religious organizations. He represents educational and charitable institutions and advises clients in litigation and corporate matters. He consults with educational institutions and their religious sponsors regarding various issues, including crisis response.

Business Experience

Ryan has considerable experience in civil litigation. He has represented not-for-profit corporations, businesses and individuals in a variety of litigated disputes. Ryan has also served these same clients in a wide range of transactional matters.

ERM Experience

Ryan advises not-for-profit and religious organizations, including educational institutions, on how to respond to crisis situations, including civil lawsuits, unfiled tort claims, law enforcement and regulatory investigations, and negative media exposure.

Professional Affiliations

Ryan is a member of the Chicago Bar Association and the Catholic Lawyers Guild of Chicago

Education

University of Notre Dame Law School, J.D., 2013

University of St. Mary of the Lake Mundelein Seminary, M.Div, S.T.B., 2007

Iowa State University, B.A., 2000

Sunshine laws are intended to promote transparency in government by requiring that information about government activities be made available to the public. Public access to this information allows citizens to make informed judgments and identify corruption and waste. Consequently, sunshine laws are critical to maintaining accountability, trust and efficiency in government.

All fifty states, the District of Columbia and the federal government have enacted sunshine laws. While these laws vary by jurisdiction, they can be separated into two general categories: open meetings laws and open records laws.

Open Meetings Laws

Open meetings laws mandate that meetings of certain government agencies be open to the public. These meetings are typically required to be held at times and places that are convenient and accessible. It is also compulsory for notices and agendas to be published in advance of these meetings and that minutes and transcripts are kept.

Generally, open meetings requirements apply only when a quorum is present and public business is discussed. However, these requirements usually do not apply to social and ceremonial gatherings held for purposes unrelated to public business. In recent years, many jurisdictions have added a new wrinkle, clarifying that electronic communications may be subject to open meetings requirements.

Open meetings laws in every jurisdiction provide for exceptions that allow public bodies to hold closed meetings to consider certain subjects. Most, but not all, provide exceptions for personnel matters, collective bargaining, litigation and the acquisition or sale of real property. However, public bodies are generally prohibited from taking action unless in public session.

To ensure compliance with open meetings laws, it is important for agencies to observe advance notice requirements and to post notices at principal offices, on websites and with the news media. Full agenda packets should also be prepared, including items subject to final action. Finally, avoid repeated use of “reply all” when sending e-mails for public business and consider a non-voting member as an intermediary for electronic communications.

Open Records Laws

Open records laws, also known as freedom of information laws, create a presumption that the records of certain governmental bodies are to be open to the public. These laws establish procedures for making requests, time limits for public bodies to respond and fees public bodies may charge for making records available.

Most open records laws broadly define the scope of records which must be made publicly available to include all documentary materials relating to the transaction of public business. However, these laws generally cover only the existing records of a public body. In short, open records laws do not compel public bodies to create or search for information that is not already in their possession or under their control.

Like open meetings laws, open records laws in every jurisdiction provide for exceptions that allow—but do not require—certain records to be withheld. Common examples include records containing confidential, proprietary, or privileged information or where disclosure is prohibited by law. Many jurisdictions also permit denial of requests that are unduly burdensome.

In an effort to abide by open records laws, prepare written policies and forms to manage requests. Be sure to document receipt of those requests and monitor all response deadlines. Also, beware of all prohibitions on disclosure laws in contracts. Make information available on a website where a requestor can be referred and communicate with requestors before denying their request.

.

By: Michael Airdo

Member, Kopon Airdo, LLC

Summary of Qualifications

Michael Airdo is a founding member of Kopon Airdo, LLC. He has extensive experience in handling complex civil litigation and transactional matters involving local governments and not-for-profit entities. He is a frequent lecturer on topics related to his legal practice ans has served on the board of trustees for the Village of Bartlett, Illinois from 2001 to 2013. He currently serves as the township attorney for several townships in Illinois.

Professional Affiliations

Michael is affiliated with the International Association of Defense Counsel, Claims and Litigation Management Alliance, Illinois Association of Defense Trial Counsel and Defense Research Institute

Education

Michael graduated from DePaul University College of Liberal Arts and Sciences with a B.A. in political science and english (summa cum laude). He also received his J.D. from DePaul University College of Law, with honors and as a member of the Order of the Coif.

By: Mark Kimzey

Associate, Kopon Airdo, LLC

Summary of Qualifications

Mark Kimzey is an associate at Kopon Airdo, LLC. His practice focuses on complex civil litigation in state and federal court. He also works with local governments on legal matters that arise in public administration.

Professional Affiliations

Mark is affiliated with the Chicago Bar Association, Illinois Bar Association and Illinois Township Attorneys Association

Education

Mark has received his B.S. degree (summa cum laude) from Western Illinois University, M.P.A. from Illinois Institute of Technology, Stuart School of Business and J.D. from Chicago-Kent College of Law.

Whitewater rafting, kayaking and river surfing are quickly becoming some of the most popular adventure sports in America. Given this growing popularity, recreation departments across the country are building whitewater parks as entertainment attractions. Before building a whitewater park in your city, town or county, it is important to understand the hazards that accompany the construction of these parks. This evaluation will require significant skills in risk identification, contractual risk transfer, signage wording, site inspection and working with your legal consultant, etc.

Infrastructure and Hazards

There are a number of approaches in which to construct a whitewater park, all of which utilize unique methods to shape the course of the river. In-channel parks modify the flow of water to create hydrologic features in the river. Out-of-channel whitewater parks divert the flow from another body of water to manipulate the river’s features. After the desired affect is applied to the course, the flow is then redirected back to the original body of water. Recirculating parks use pumps to move water to and through specific areas. Parks may also employ diversions to obstruct or move water off-river, similar to a dam.

All methods of construction require man-made infrastructure to create chutes, waves and pools. The complexity of the infrastructure used also introduces risks. As a result of these additional risks, it is especially important to hire experienced contractors and engineers that specialize in whitewater infrastructure, water sports knowledge and hydraulics.

One type of artificial infrastructure that is commonly used on whitewater courses is a weir. A weir is a short dam built across a river to increase the river’s depth upstream. This causes the water to spill over the top, often creating a current flow on the backside of the structure that can entrap swimmers and watercrafts. Cement blocks are also commonly used in the construction of whitewater parks, which can often be as large as small cars. They are placed strategically throughout the course to create waves or chutes and often use existing rock from the river bed. The rapids that result from these material often lead to increased water movement. Due to seasonal water flow fluctuations, the park may shift from a low hazard level to a moderate hazard level in a matter of seconds.

Inspections and Signage

In addition to routine inspections, consider increasing inspection frequency during times of drought or high rainfall. Hazards posed by low or high water should be included in park signage so that visitors can take appropriate action depending on the seasonal flows observed that day. When considering the severity of the risks involved, whitewater parks should be signed as “use at your own risk” and “unsupervised facility.” The signage should also recommend that a user wear appropriate safety gear, such as a life preserver and helmet.

After identifying the hazards for the type of park you wish to construct, other items to explore include recreational immunity and general liability. Check your state’s statutes regarding these factors, as well as for duty to warn and protection lost if a fee is charged.

Risk Management Plan

While whitewater parks are growing in popularity, the risk management guidance information is limited. One of the best forms of protection against litigation and liability is a strong risk management plan developed in conjunction with your entity’s legal counsel. A risk management plan for a whitewater park should include, but not be limited to, designing the course using whitewater industry consultants/contractors, using signs to warn visitors of the risks at hand, developing a use-at-your-own-risk approach, recommending appropriate life preservers/helmets and routine inspections with documentation.

If your public entity is considering adding a whitewater park, consult with not only your risk management team, but also an engineer specializing in the infrastructure.

By: Kenny Smith

Risk Control Manager, OneBeacon Government Risks

Summary of Qualifications

Certified Safety Professional (CSP)

Responsibilities

Development of risk management resources and training programs for clients.

Business Experience

Kenny has had a focus in local government since 2001 and has 37 years of risk control experience.

Professional Affiliations

Colorado ASSE

Education

BS from West Texas A&M

Just as fictional TV newsman Ted Baxter on The Mary Tyler Moore Show had humble beginnings (“It all started at a 5,000 watt radio station in Fresno, California”), so did social media. Emerging as bulletin board systems (BBS), progressing to platforms like CompuServe and AOL, then transforming to the now-ubiquitous Facebook, LinkedIn and Twitter, social media has evolved from a unique space for narrowly focused hobbyists to the medium of choice for information sharing.

Most communities use social media

Today, besides people using it to share the latest cute kitten video or network with like-minded professionals, local governments are using social networking platforms to reach out to their citizens.

It is estimated that more than 85 percent of the 75 largest cities in the U.S. utilize social media, according to Rutgers. It has now filtered down to smaller cities and towns, with more than 50 percent in some studies reporting a high level of use of at least two platforms. These towns are engaging the eight out of 10 people using Facebook regularly and the more than 25 percent on other platforms like LinkedIn, Twitter and Pinterest.

The advantages for governments using social media

Local governments using social media to engage with their communities can enjoy many benefits. The platforms can increase citizen participation in local decision-making, enhancing the public perception of the town, its leaders and staff. Local businesses, schools and non-profits gain exposure by informing people about events, activities and fund-raising efforts. Law enforcement gains support for its efforts to report and monitor public safety. Social media has become today’s town square, local newspaper and neighborhood coffee shop rolled into one.

The challenges of social media

Although it has its benefits, don’t forget that all technology creates challenges and responsibilities. Cities should define what objectives they want to achieve with social media and align their presence with those goals. Common-sense policies and procedures should be written and broadly shared within departments. While some larger governments now have employees specifically hired to act as “social media coordinators,” most towns continue to administer their social media presence ad hoc. If you don’t have a staff position dedicated to social media, identify a heavy user who, with some training, is willing to act as your “social media ambassador.”

Craft a sound, legal social media policy

Understanding the legal implications is also crucial. Research your state’s policies for local governments on open meetings, public records and retention. Be aware of First Amendment implications, and remember your archive policies need to match Freedom of Information Act requirements. Your community is not alone on these platforms. Peer governmental entities offer many resources to help you craft an effective social media policy.

Social media can be an effective public safety tool as well

Don’t let the challenges discourage your town from participating in social media. Citizens appreciate the information on severe weather and road closures, town meeting reminders and the general opportunity to talk (yes, even virtually) with town leaders and fellow citizens. Even more importantly, recent events – from multiple catastrophic hurricanes to the California wildfires – have shown how well-thought-out social media communication plans can enhance emergency management and response. Feel free to join the conversation!

By: Thom Rickert, CPCU, ARM, ARM-P, ARM-E, ARC, ARe

Emerging Risk Specialist, Argo Group

Summary of Qualifications

Thom has enjoyed a 37-year career in the insurance industry and is currently with Argo Group U.S. as an emerging risk specialist. Rickert has extensive underwriting and marketing experience in all property and casualty lines of business, spanning multiple segments and industries. He has been responsible for implementing corporate compliance and efficiency projects and has served as a business leader for technology solutions in policy administration, underwriting, channel management, and business development analytics.

Responsibilities

As an emerging risk specialist, Rickert extends his view to trends influencing the future of risk and insurance. He is also responsible for building and cultivating a high-performance marketing discipline that creates value and relevance in the public sector marketplace. In this role, Rickert is actively involved with shaping Trident Public Risk Solutions', an Argo Group company, business strategies, growth action plan, product development and enhancement, as well as distribution channel management.

Business Experience

Over a 35 year insurance career, Thom has held various staff and management positions in underwriting, marketing, sales, systems administration and training & education for U.S. and internationally domiciled commercial insurance carriers and brokers. He has also served as president and chief operating officer of an independent commercial lines insurance agency.

ERM Experience

Thom holds The Institutes' Associate in Risk Management - Enterprise-wide Risk Management (ARM-E) designation. He currently acts as the enterprise risk management focal point for his business unit. Thom supports the business in ensuring that risk management is integrated into the function of the unit and that the threat and opportunity risk and control profile is accurately captured and positively managed on an ongoing basis.

Professional Affiliations

Public Risk Management Association (PRIMA), Risk Management Society (RIMS), Governmental Finance Officers Association (GFOA), Association of Governmental Risk Pools (AGRiP)

Education

Trinity University (San Antonio, TX) - BA - Philosophy and History

Chartered Property Casualty Underwriter (CPCU)

Associate in Risk Management (ARM), Associate in Risk Management – Public Entities (ARM-P), Associate in Risk Management – Enterprise-Wide Risk Management (ARM-E)

Associate in Insurance Regulation and Compliance

Associate in Reinsurance

SIX SIGMA – Green Belt Certified

It’s request-for-proposal time again for workers’ compensation and property & casualty claims administration. What should you do? Should you regurgitate the past proposal questions? Should you just re-sign with your TPA? It’s time to decide what is best and what may be counterproductive for your RFP development.

COUNTERPRODUCTIVE:

If you write the proposal without determining what has changed in your program over time, it may not be complete and it will not be optimized to make an informative decision. Preparing to write a proposal does not mean writing for only a narrative response or compliance with purchasing’s RFP requirements (timing, contract terms, etc.). It means preparing targeted questions to make sense of what is vital to your claims program. For example, there may be sections of your proposal that are routine, such as required settlement authority, caseloads and reserve practices. There are also sections where you think nothing needs to change, such as enhancements in risk management information systems and imposed pharmacy benefit management regulations. It is important to address everything claims related.

Knowing what you are about to structure in your proposal and discussing it with a TPA may also be helpful. Arranging for time to meet before proposal release, rather than the email question and answer process in the early, time-limited stages after RFP release, can help you organize better. Also, pre-RFP meetings can reduce any errors or misinformation otherwise not caught in the final presentation process, or worse, after contract signing.

Your claims program must not be run as if it were a commodity; people who have a vested interest in your risk management program must execute it. Scoring pricing with an all-is-equal attitude can hurt your outcome. Heavily weighting pricing will make it more likely that the TPA will describe the service either without all of the details or by “throwing the kitchen sink” into their response for you to decipher.

PRODUCTIVE:

Ask the proper questions and ask the most important ones twice. You want to be able to not only write a comprehensive proposal, you also want to reinforce through repetitiveness what sections of the proposal are most important to you. Whatever you believe is essential should be included in a questionnaire, but you may also suggest the TPA discuss these matters in a methodology section or response to a scope of services agreement. Also, allow the TPA to address how they can assist you best. You can do so by enabling them to differentiate themselves and explain what their value proposition may be. The key takeaway is clarity in questioning and instructions to best prepare for the rest of the process. After all, you do not want the wrong finalists at your presentation table.

Before drafting a proposal, it would benefit you to include key reviewers to discuss areas of concern for claims administration. Parties involved in the review process may consist of loss control and safety personnel, or department/division managers or supervisors, each of whom is intimately familiar with lost-time woes and the causes of the injuries or P&C incidents. Key personnel can provide valuable insight. What claims investigation approaches are you going to take? What staff will you offer us? Who pursues subrogation?

In addition to pre-proposal preparation, the final decision will be more effective if key risk management personnel sit on the review panel. You should compare everything against your requirements, such as the TPA’s willingness to comply, price versus value and clarity over the canned response. When you join forces, you are more likely to choose the best presentation finalists and ultimately the best solution for your programs.

Lastly, you should consider your time and the time of your reviewers when drafting a proposal. You may have to review multiple responses at one time and within a particular, time-limited schedule. Hint: if you ask targeted questions and limit the answers to a few sentences, you are likely to receive a clearer response. Additionally, placing a limit on the total number of pages is another consideration to keep the responder focused. Leave the rest for the appendix. The more you can do to limit the proposal response before the RFP is released, the better your chances of being able to verify that your program matches the TPA’s offering before the deadline forces you to choose finalists and plan schedules.

By: Thomas Newman

Senior Marketing Analyst, Alternative Service Concepts

Summary of Qualifications

Thomas has nine years of experience in the workers’ compensation and property and casualty industry working as a senior marketing analyst for Alternative Service Concepts, a third party administrator (TPA). Prior to his role, he worked in marketing for an unemployment claims company, a telecom manufacturer and international public relations agencies since 1993. He is an ARM candidate with an anticipated completion date of 2018.

Responsibilities

As a senior marketing analyst, Thomas handles all RFP technical writing, public relations, collateral creation, data analysis and miscellaneous marketing and sales support initiatives.

Professional Affiliations

Thomas is an exhibiting pariticipant at PRIMA's Annual Conference.

Education

Bachelor of Arts in communications and public relations from Long Island University, C.W. Post

Employees have dramatically changed in comparison to the workforce of 25 years ago. Starting in 2012, 10,000 Americans a day turn 65. Many of these Americans will continue to actively participate in the workforce.

With the changing demographics, further attention is required to ensure our employees remain safe and potential injuries are prevented. Within the next decade, 40 percent of the labor force will be eligible for retirement and as many as 75 percent of older adults expect to work after age 70.

Many older workers defined as 55 or older do not have adequate savings to support full retirement and cannot live at the standard of living for which they have become accustomed; therefore, they must work to support their lifestyle choices. In addition, depending on your date of birth, electing to take Social Security earlier at the age of 62 will create a reduction in benefits from 20 percent to 30 percent. Retirement age will soon reach 70 years old, if you chose to receive the maximum benefit.

Let’s start with understanding the effects of aging. The normal aging process affects every area of the body. Generally, as an individual ages they will experience decreased strength and range of motion, vision and hearing loss, reduced cardiac and lung function and balance changes that can increase the risk of falls. There is also an increased incidence of chronic conditions, which require medication management and side effects that go along with them.

This can impact the top five types of injuries of an aging workforce, which include rotator cuff sprains, lumbar disc disease, knee cartilage injuries, brain injuries (due to high risk of falls/MVA), and nerve compression conditions such as carpal tunnel syndrome. Decreased blood flow from reduced cardiovascular capacity, pre-existing osteoarthritis, and diabetes can impact the healing of these common injuries.

Now that we understand the increased risk, prevention is the key. To prevent the most common injuries for aging, or any, employees we can start with the basics. Any work area should be well lit, clear of clutter, clean, dry and with cushioned walking or standing areas if possible.

The costliest injury of employees age 50 to70 is an injury to the rotator cuff. To protect the shoulder, overhead work needs to be limited, if unable to be eliminated, and closely monitored. Lumbar conditions make up the next highest cost of this demographic. Minimizing heavy lifting, offering proper lifting training and reinforcement, and avoiding static positions including standing, are all valuable to maintaining proper low back protection. Avoiding or minimizing work on ladders will also help protect the third cost driver, the knee. Providing even working surfaces to prevent a slip, trip, or fall is also essential.

It’s important to identify the differences in diagnostic results in a population over the age of 55. By age 67 at least 30 percent of the population will have degenerative rotator cuff tears in both shoulders. These tears are not due to an acute injury and, in general, it is advisable to undergo a surgical repair. For the lumbar spine, degenerative disc disease (DDD) is not actually a disease but rather a normal aging process in the body. People with DDD are asymptomatic in 46 to 93 percent of cases. It is an incidental radiographic finding unrelated to the symptoms. Spinal stenosis is a narrowing of the spinal cord space with possible spinal cord compression. Spinal stenosis is common in people older than 60 and the vast majority of patients have no symptoms.

Osteoarthritis is a normal finding in the knees of aging workers. If an employee is above the recommended BMI this could have an additional impact on the wear and tear of their knees, which contributes to the amount of osteoarthritis and internal derangement found in testing. Overall, an aging worker may take longer to heal.

The process is similar to any claim regardless of the age of the injured employee. During the initial evaluation gather as much medical and supplemental information about the accident or injury as possible. During conversations, introduce and encourage the plan for return to work. Early intervention remains crucial. It always better to anticipate obstacles and prevent them from materializing, rather than trying to chase and manage problems after they have developed. Staying in touch with the injured employee remains imperative. In asking about the individuals general health, a lot of information can be obtained about how they are healing from their injury. Emphasizing the focus of increasing function and managing their symptoms can also be beneficial. Allowing transitional duty to ensure a successful return to the workforce can also be valuable.

The aging workforce is a factor most employers deal with today. Knowing the risks and how to manage them will provide an advantage in handling the complicated claims that can occur.

By: Patty Reinecke RN, BSN, CCM, MSCC

Senior Medical Management Consultant, Midwest Employers Casualty

Summary of Qualifications

Patty is a certified case manager with 23 years of experience directly handling workers’ compensation claims.

Responsibilities

Patty is responsible for working in concert with internal and external team members to employ the most effective cost containment measures to medically stabilize claims. She reviews and interprets medical data to ensure all treatment is reasonable and necessary. She also projects future medical costs based on current diagnosis and treatment and develops partnerships with external third party administrators, attorneys, employers, internal analysts and attorneys to develop a plan of action to bring cases to successful resolution. Patty evaluates Medical Set Asides (MSAs) to ensure the allocations are accurate to prepare for settlement of workers’ compensation claims.

Business Experience

Midwest Employers Casualty

Senior Medical Management Consultant, August, 2008 – present

Missouri Baptist Medical Center

Manager, Workers’ Compensation Department, December 2003 – August 2008

Broadspire (formerly Kemper National Services)

Senior Regional Supervisor, February 1997 – November 2003

CorVel Corporation

Onsite Case Management, June 1994 – January 1997

Professional Affiliations

Certified Case Manager (CCM) #021861

Medicare Set Aside Certified Consultant (MSCC) #1043

Education

Maryville University, Bachelor of Science in Nursing, May 1993

Any safety professional that has to deal with the seemingly constant exposure to risk from EMS and fire-rescue first responders has no doubt struggled with finding solutions. The Center for Disease Control (CDC) and the National Institute for Occupational Safety and Health (NIOSH) released recommendations detailing the 5 root causes of exposure in the field. These include:

- Body Motion injuries form excessive physical effort, awkward posture & repetitive motion.

- Slips, trips and falls

- Motor vehicle incidents from sudden stops (unrestrained in the ambulance), swerves and crashes.

- Violence & assaults

- Exposure to harmful substances

The CDC/NIOSH goes on to make recommendations for handling these five areas of exposure, in turn addressing the question: How do we truly reduce exposure to these risks in such a dynamic environment?

EMS and fire-rescue have the best patient-handling (lifting, moving, pushing, pulling, carrying, sliding) technology ever. Yet the root cause of many injuries to emergency personnel stem from transporting the patient to and from the engineered solution (e.g. cot or stair chair). First responders must adhere to a methodology that facilitates safer use of the patient-handling tools at their disposal. Resource

The effectiveness of any safe patient-handling methodology is minimized when the first responder has poor biomechanics. Obesity, poor mobility and poor job specific strength are all huge contributing factors to risk exposure. Here is a mantra to take heed to in an effort to promote wellness, especially while on the job: “You have to move well before you can move patients/gear well.”

Many wellness programs fail to meet the needs of shift workers, as they are geared to the 9-5 crowd. Driving errors, medication errors, soft tissue traumas and simple human errors (such as those that result from fatigue) serve as common risks that are rarely addressed. It is vital to teach responders how to make educated decisions regarding food choices in an ever-changing environment, how to employ sleep hygiene strategies and, most importantly, how to manage their health. Shift work and working in high stress environments can prime first responders to commit the aforementioned errors and may also result in PTSD and resiliency issues.

Assaults against EMTs are under-reported yet they are a major cause of exposure, injury and PTSD. There are validated training systems that teach responders how to deescalate, evade and, as a last resort, defend against an attacker. Resource

Ambulances should be fitted with modern restraint systems with forward facing 4-point harnesses that have the ability to keep the EMT seated at all times. Up-to-date ambulance specifications are recommending this standard. In a call back to overall wellness, employees should also be educated on fatigue mitigation and effective sleep practices to reduce exposures related to operating a motor vehicle.

In an effort to address the potential complex nature of any given risk, it is important to work with your safety staff and get in front of the crews. Talk to them, find out their needs and concerns and work as a team to determine the best plan to help these dedicated first responders thrive, survive and ultimately reduce their risk in such a hazardous profession.

By: Bryan Fass, ATC, LAT, CSCS, EMT-P

President & Founder, Injury Prevention Systems & The Fit Responder

Summary of Qualifications

Bryan has dedicated the past 10 years to changing the culture of Fire-EMS & Law Enforcement from one of pain, injury and disease to one of ergonomic excellence and provider wellness. Bryan has leveraged his sports medicine, athletic training, spine rehabilitation, strength & conditioning and paramedic experience to become the expert on pre-hospital patient handling, equipment handling and first responder fitness. Bryan founded Fit Responder & Injury Prevention Systems to work with pools, leagues, insurers and public entities to promote the wellness of first responders.