Snow and ice can do a number on roofs over a long and cold winter, especially if there is no process in place for inspections and maintenance. You can minimize the risk of snow loading and roof collapses by planning, preparing, and taking prompt action to remove accumulated snow. This article will set out to highlight the main ways to focus on monitoring and preventing roof damage throughout the winter.

What to Look For

Visible damage and debris – The first step to inspecting a roof is looking for obvious signs of damage, including visible structural deformations, dirt and debris, standing water, and blocked or broken gutters and downspouts. Any obvious damage should be repaired shortly after discovering it.

Exterior structural components – All external structural components of the roof, including chimneys, vents, fascia, drip edges, and decking should be inspected for damage, missing components, rust, and rot. Leaks tend to form around chimneys, vents, and skylights; if they're not noticed in a timely manner, damage can occur to the underlayment, sheathing, and joists, leading to potentially expensive repair and replacement costs.

Interior roofing components – When roofs are not inspected regularly, interior structural damage can occur. Often, due to a lack of regular maintenance, interior damage is the first to be noticed. On sloped roofs, the location of the damage may not directly point to the location of the leak. Water follows the path of least resistance, which means the source of the leak is often not above the visible damage. If a leak has been left to linger, rafter and roof trusses should be checked for evidence of mold, mildew and rot, which could indicate extensive structural damage.

At a minimum, a comprehensive maintenance program for roofing systems should include these basic steps:

- Keep roofs clean and free of debris.

- Remove snow to prevent a buildup of snow and ice in particular spots on the roof.

- Keep drainage systems clear and functional.

- Train maintenance personnel on the requirements of working with the roof system.

- Restrict roof access to authorized personnel.

- Limit penetration of the roof system.

- Use professional roofing contractors who stand behind their work.

When to Look

While a spring inspection would reveal potential damage that might have occurred from severe winter weather, a fall inspection would reveal any preventative action required before winter arrives. An inspection should be conducted after any major storm or construction activity that might cause damage to the roof, including any recent heavy snowfalls. Always take extra precautions and have someone with you when inspecting roofs in the winter.

During a winter storm, it can be dangerous to be on the roofs. It is best to be prepared to act after a snowfall.

- Do not allow unauthorized workers/persons on to roofs. All workers should be properly trained on snow removal and equipment use.

- Remove the snow systematically to maintain the balance of the structure. Use shovels and wheelbarrows. If using a snowblower, ensure that the auger is set to the highest level to prevent damage to the roof.

- Do not create snow drifts by moving snow from one area on another.

- Verify all drains are clear of ice and snow to allow melting and runoff. If the roof is pitched and without drains, open paths to the eaves to ensure drainage and prevent ponding.

- Inspect for any other roof damage and make necessary repairs when it is safe to do so.

Safeguards When Doing Inspections

The following safeguards will assist with prevention of roof collapses:

- Have a fall prevention plan that is compliant with local agency requirements before engaging in roof preparation activities.

- Keep workers trained and the proper equipment available for snow removal, as well as proper PPE for the elements.

- Continuously monitor winter storms and remove snow off roofs as soon as possible after each snowfall.

- Keep all drains clear and unblock debris (leaves, dirt, etc.) year-round. The downspouts should also be clear.

- Keep an updated winter emergency response plan in effect, especially for snow removal.

- Confirm generators are in good condition and their fuel tanks are full.

- Ensure fire hydrants and fire protection system control valves are visibly marked to avoid damage from snow removal equipment.

Roofing maintenance and inspection is a process that needs attention year-round, and preventative maintenance is something that goes a long way in making life easier for maintaining these roofs over a long period of time. Sticking with a diligent schedule and checking up on roofs after severe storms are fundamental for a comprehensive roof maintenance program. Combining these elements of preparation, planning and inspecting will make for great roofing care and less costs on repairs or replacement projects in the long-term.

By: Michael Neff

Loss Control Consultant, Berkley Risk

Summary of Qualifications

Michael holds a Bachelor of Science in Occupational Safety & Health Management and has six years of loss control consulting experience. This experience includes mainly working with cities and counties through both property & casualty and excess liability coverages.

Responsibilities

Schedule and put together agenda for in-person loss control meetings and walk-throughs with clients. These clients include cities, counties, roofing contractors, manufacturing, assisted living homes, foundries, etc. Review claim trends and create responses on loss control questions our clients reach out with.

Business Experience

2023 - Present: Loss Control Consultant with Berkley Risk

2019 - 2023: Loss Control Consultant with the League of Minnesota Cities

2018: Environmental Compliance and Safety & Health internship with EJ, Inc.

Professional Affiliations

- American Society of Safety Professionals

- Public Risk Management Association

Education

- Grand Valley State University 2019 - Bachelor of Science

Approximately 66 percent of all school injuries are unintentionally caused by interactions with special education students. Bites, scratches, punches, and facial injuries, among others, can be minimized by wearing personal protective equipment. However, once a student engages in a behavior, prevention has passed, and it is important to minimize the injury by wearing personal protective equipment. The goal is to prevent injuries by de-escalating a student before an injurious behavior occurs. How can this be accomplished?

Teachers and support staff know students well. It is important to train and remind staff that if a student appears dysregulated, they should use de-escalation techniques before a behavior that can cause an injury is manifested. The most effective de-escalation technique is the use of sensory, and it is critical that teachers have sensory resources available and understand how they are successfully used to regulate students’ behavior.

Ideally, school buildings should have a sensory room where students can engage in various sensory-based activities designed to calm and regulate a student. The use of tactile walls, compression canoes, swings, and tunnels, among other resources, is very effective. Having a variety of sensory resources in a room allows a student to gravitate toward a personal preference. A mobile sensory cart is a great idea if a school building does not have dedicated sensory space. This cart can be shared among classrooms. A plethora of smaller sensory items can also be used within a classroom.

A student’s favorite is weighted animals. For students who are often out of their seats, placing a weighted animal on their lap provides compression and tactile sensory that comes from an animal with movable sequins or crinkle paper within the material. Often, this is enough to regulate a student so that they remain seated, the lesson can be completed, and potential behaviors can be extinguished.

It is important to provide staff with sensory resources and engage them in professional development, so teachers understand how to use such resources to de-escalate students. Taking the time to model the use of sensory in a classroom is necessary. Simply handing out resources will not work. Teachers must understand the purpose and the variety of ways sensory materials can be used with students. I have seen many cases where teachers try something once and give up. Teachers must be persistent. I give the analogy of learning to play basketball. How many times does it take for a student to make their first basket? Many attempts and then the student builds the skill and gravitates towards the activity because they achieved success. The same can be applied to sensory integration in the classroom. The student may push sensory items away many times before selecting a preference and validating that the sensory is calming. Introducing a culture of sensory will be an investment of time and training.

Remember, the sensory equipment investment is paid back by fewer claims, lower premiums, and engaged and happier staff.

By: Angela Nagle, Ph.D

School Risk Management Specialist, Public Employer Risk Management Association

Summary of Qualifications

Angela Nagle joined PERMA three years ago after retiring from public education in New York State. Angela is a former Superintendent of Schools, Assistant Superintendent for Curriculum and Instruction, Director of Pupil Personnel Services, and teacher.

Responsibilities

Angela provides risk management services to school districts and Board of Cooperative Educational Services (BOCES) throughout New York State. With approximately 66% of all staff injuries caused by interactions with special education students, Angela applies her expertise and risk interventions to lower this risk substantially through professional development-school safety trainings, use of personal protective equipment, and sensory integration throughout the school day.

Angela observes classrooms with reported staff injuries and through a process called (RISE) Reducing Injuries in Special Education, lowers staff injuries.

Professional Affiliations

- New York State School Boards Association

- New York State Council of School Superintendents

- AMCOMP

Education

- State University of New York at Albany, Doctorate of Philosophy, Educational Administration and Policy Studies

- College of St. Rose, Masters of Science, Special Education

- Siena College, Bachelor's of Science - Marketing/Management/Business Administration

- WCP Designation - AMCOMP

The outlook for financial markets remains as uncertain as ever while they navigate a post-election environment that affects the easing of interest rates, employment (i.e. labor supply & demand), and investors’ earnings expectations. Yet, amid this uncertainty, public entity insurers must generate sufficient, predictable investment income to support underwriting results.

For many public entity insurers, such as government risk pools, joint powers authorities, self-insurers, captives, etc., that means an investment portfolio already hamstrung by asset class restrictions – typically limited to US Treasuries and Agencies – faces even further pressures and potential volatility.

Even for public entity insurers that are allowed to invest in a greater scope of investment-grade bonds or have the flexibility to invest in risk assets (i.e. equities, bank loans, high-yield bonds, etc.), it will be a difficult time to assess the benefits of short-term changes versus the long-term horizon intended for public entities.

With such an uncertain outlook on the horizon, public entity insurers must invest prudently. But what should they do?

First, public entity insurers should be sure to focus on the overall investment process.

Start with the basics, which are surprisingly little followed all of the time.

Markets go up, down, and sideways, and, many times, surprise the so-called experts. However, what doesn’t change is that what is most important is making investment decisions that are correct for your entity, irrespective of what you may see, hear, read or smell about financial markets.

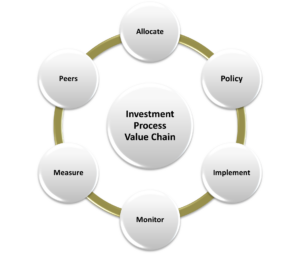

Investment basics revolve around the “Investment Process Value Chain,” which encompasses the six most important parts of a public entity’s investment process.

Why focus on process? A good process should produce good results over the long term.

To illustrate, if poor results ensue from a good process, such outcomes would be considered bad luck. Meanwhile, it is possible to get good results from a bad process. That, too, would be luck. But, this time, it would be good luck, since you would expect poor results to come from a bad process.

Many investors focus solely on the results. “Just give me the bottom line. Did we beat our benchmarks or not? Are we getting the yield we need or not?” These are worthy sentiments, but besides there being better questions to ask than those, they do not focus on the process.

Here’s a simple explanation of the “Investment Process Value Chain” and how, if focused on an improved investment process, public entity insurers can manage much of the financial market uncertainty over the long term.

1. Investment Policy – These can be anywhere from two-page policies to near handbook-length documents. However, a ‘best practices’ policy has five important sections. And what may be the most important section is the one the I see missing all too often: Corporate Governance - Who is responsible for what, when, and how?

This is also not a static process; new investment alternatives, changing regulatory environments, and evolving operating conditions mean that reviews should typically be conducted annually.

2. Strategic Asset Allocation – This goes hand in hand with the policy since the results of a comprehensive asset allocation analysis – one that considers assets, reserves, capital, income, different interest rates and economic scenarios, etc. – will ultimately determine most of the total return a public entity will receive.

3. Investment Manager Evaluation and Selection – Most public entity insurers will utilize an external investment manager to manage the portfolio. What is key is keeping their performance, adherence to the entity’s goals and objectives, and any material firm changes top-of-mind. A disciplined approach to manager evaluation and selection that takes into account the manager’s investment process, philosophy, people, and systems is a good starting point

4. Portfolio Monitoring – Since most public entity insurers don’t have a Chief Investment Officer (or similar position) on staff, most will meet with their investment manager quarterly and have little communication with the manager intra-quarter, unless something unusual or unexpected occurs. However, it is usually better to anticipate and monitor potential areas for discussion rather than awaiting those end-of-quarter communications. Discussions would include analyzing expected credit losses, assuming investments are being made outside US government-related bonds, and stress testing the portfolio for potential ‘black swan’ type events. Anticipating changing risks before they may occur becomes part and parcel of portfolio monitoring.

5. Performance Measurement – This is an area most public entity insurers would say is handled quite well given monthly/quarterly reporting. However, it is important that public entities also review metrics like risk-adjusted performance (since there is no return without some risk)? Does the public entity know how the manager’s performance compares to various other similar investment managers? Importantly, there are many other ways to view performance measurements, including monitoring how your public entity insurer is progressing in improving the overall investment process.

6. Peer Group Analysis – While not always easy to conduct, it can be helpful to gauge how the portfolio may compare to others. While more holistic in nature, peer group analysis can prompt key questions such as, “Why do you think are they doing that?” “Is this a strategy we should consider? Why? Why not?”

While the financial markets and operational expectations will certainly fluctuate over time, a better understanding of the overall investment process can prompt public entity insurers to take an overall, detailed look at how the investment portfolio is tied to its organizational goals and objectives. This, in turn, helps improve the chances of achieving positive investment results even during uncertain times.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Alton Cogert

President & CEO, Strategic Asset Alliance

Summary of Qualifications

Mr. Cogert formed Strategic Asset Alliance in 1994, an investment consulting firm that only works with commercial insurance companies and public entity insurers, such as risk pools, JPAs, self-insurers, captives, etc.

Mr. Cogert is an Independent Member of American Fidelity Assurance Company's Investment Committee of the Board. He previously served as a technical advisor to the NAIC Invested Assets Working Group. He is a former member of the Board of Directors and former chairman of the Investment Committee of the National Alliance of Life Companies.

Responsibilities

In addition to acting as an investment advisor to public entity insurers, commercial insurers, risk pools, captives, etc., Mr. Cogert leads the firm as its President & CEO.

Business Experience

Prior to SAA, Mr. Cogert accumulated more than 20 years of financial institution experience, including over 10 years experience in senior financial management.

Professional Affiliations

He is a Chartered Financial Analyst, a Certified Public Accountant, Chartered Alternative Investment Analyst and a Financial Data Professional Charterholder.

Education

Mr. Cogert holds a BS from the Wharton School of the University of Pennsylvania and an MBA from the University of Southern California.

We all know them. We’ve either worked for them or supervised them. That first-line supervisor who just won’t commit to the level of productivity, responsibility, and accountability needed to be an effective leader. It happens in government agencies, including police and fire departments, jails and correctional facilities, and at the city, county and state level. These ineffective “leaders” permeate private companies too.

What does it look like?

- Shirking responsibility. Waiting it out as others step up for assignments, sometimes having to be “voluntold.”

- Not accepting or fostering accountability. It’s always someone else’s fault, or the organization wasn’t supportive enough, didn’t provide resources, didn’t address low morale. (Never mind they could tackle these issues themselves.) Sometimes, they’re just more concerned with being friends with direct reports.

- Low productivity. Many problem supervisors are promoted because they are charming and competent communicators. But they use the gift for gab to appear busy and avoid work.

Identify problems early. Stay alert!

Other symptoms:

- Spending an hour in your office. It starts with a legitimate question but becomes a discussion about, literally, the kitchen sink.

- Complaining. No one else does their job correctly.

- Micromanaging. Lack of self-confidence leads to no confidence in others.

- Disappearing. Naps or personal errands on company time.

- Unavailability. Their input is needed but they can’t be found.

- Emphasizing non-work tasks. Deciding where to eat lunch becomes the morning’s focus.

- Not delivering. Work product is late, incomplete, or not submitted.

Diagnosis: Pathological First-Line Supervisor

The long-term effects of a Pathological First-Line Supervisor are far-reaching and create significant consequences for your organization.

Overall Risk. These supervisors often exhibit destructive behaviors—abusive supervision, incivility, an uninvolved style of supervision—all linked to psychological distress, ineffective work behaviors, and reduced employee safety. The results? Decreased productivity. Higher reportable incident rates. A compromised company reputation. Significant negative impacts to your company’s financial and operational success.

Decreased morale. Pathological supervisors severely impact employee well-being. Research shows that when supervisors mistreat employees, they disengage, suffer from emotional exhaustion, and become overtly counterproductive.

High turnover. Perhaps the most concerning is how the presence of a pathological first-line supervisor can negatively affect employee retention. Employee retention ensures operational continuity, reduces training and recruitment costs, and sustains your organization’s vision, mission, and values. Unhappy employees start job hunting to escape their hostile environment.

This malady progresses in two ways: Catch it early, intervene and create a healthier environment for your employees. Leave it untreated, the problem will worsen, and removal will be necessary.

Treatment - Focus on the whole problem, not just individual symptoms.

- Assess. Is it an isolated incident rather than a systemic issue? Address it internally. But if the issue is systemic, you may need a reputable consultant to assist you with a comprehensive evaluation.

- Treat. Proper treatment mitigates hazards. Interventions include:

- Creating or revising policies

- Training or coaching

- Attention to wellness issues

- Modeling accountability at all levels

- Disciplining: probation, reprimands, or termination

- Document. If you didn’t document early symptoms and intervention, it didn’t happen. Documentation alone may encourage change. Firing any employee without proper documentation puts your organization at risk for lawsuits.

- Reassess. Develop a clear plan to assess the effectiveness of interventions. As a former colleague of mine once said, “Don’t expect what you don’t inspect.” Creating a culture of accountability is a critical component of an effective leader in any organization.

Whether your company’s focus is people or products, you require effective first line supervisors to exceed performance goals. Let’s identify and treat pathological supervision before it metastasizes.

Sources linked in article:

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Theron Bowman

Founder and CEO, The Bowman Group

Summary of Qualifications

Dr. Bowman has nearly 40 years of high-level law enforcement and extensive public safety experience. He is a former Arlington, Texas, police chief, and, as former Arlington deputy city manager, was director of public safety. As CEO of The Bowman Group, a police and public practices consulting firm, Dr. Bowman assists organizations in strategic planning, efficient resource allocation, talent development, and budget optimization. A visionary leader with a commitment to excellence, professionalism, education and innovation, his research areas include police administration, community policing, constitutional policing, and public organization theory among others. He also serves as a public safety insurance risk management advisor for public organizations and private insurance companies.

Dr. Bowman’s big-picture perspective is key to his lifelong dedication to making a difference. With his vast knowledge and counsel, organizations learn to thrive in the ever-changing 21st-century landscape.

Responsibilities

As primary consultant of The Bowman Group, Dr. Bowman offers direction on investigating and developing reform measures for police practices and policies regarding management and accountability, among others.

His research and consulting activities cover a broad range of private, public safety and government issues including racial and ethnic justice, federal consent decrees designed to eliminate patterns and practices of constitutional and civil rights violations, the monitoring and implementation of consent decrees and Department of Justice agreements with law enforcement agencies, as well as best practices and professional standards related to -use-of-force policies, misconduct complaint systems, and hiring, training and retention practices.

Dr. Bowman leads a team of subject matter experts dedicated to offering invaluable strategic guidance and innovative solutions to police, public, and private organizations facing multifaceted challenges. He fosters a culture of accountability in all his endeavors to help organizations identify and mitigate potential risks.

Business Experience

In addition to his work as a law enforcement officer and executive, Dr. Bowman has more than 30 years of experience leading and managing some of the most complex and sophisticated police and public safety operations in the world. His expertise as a U.S. and international police practices expert includes consulting some of the largest jurisdictions in America, including New York City, Baltimore, Chicago, Memphis, Milwaukee, Seattle, Fort Worth, Dallas, Orlando, Arlington, and New Orleans to name just a few. He has provided technical advice to international civilian police task forces deploying in Bosnia, Kosovo, Haiti, Israel, Jordan, Iraq, and Afghanistan. He was also invited to introduce the philosophy and practice of community policing to Brazilian and other South American National Police Forces. He is an International Police Practices Expert for the U.S. Department of Justice, U.S. Department of State, and the London Metropolitan Police.

Dr. Bowman served as a CALEA Commissioner for six years where he reviewed the policies and practices of more than 1,000 police departments of all sizes. He has successfully managed hundreds of special events, including political demonstrations, concerts, and dignitary protection details. Dr. Bowman also has extensive experience in overseeing, managing, and reviewing large-scale security-sensitive events such as the NFL Superbowl, NBA All Star game, and multiple MLB World Series games.

Professional Affiliations

• Governing board chair, Texas Regional Center for Policing Innovation

• Former board member, former executive committee member and member, International Association of Chiefs of Police (IACP)

• Founding member and past president, Texas Association of Police Personnel Officers

• Former chair, Texas Intelligence Council

• Member, National Organization of Black Law Enforcement Executives

• Member, Police Executive Research Forum (PERF)

• Former commissioner and member, Commission on Accreditation for Law Enforcement Agencies (CALEA)

• Member, American Society of Public Administrators

• Member, Texas Police Association

• Member, The Institute for Law Enforcement Administration

• Member, North Texas Council of Governments

• Adjunct professor of sociology, criminology and criminal justice at Texas Christian University, the University of Texas at Arlington, Texas Wesleyan University, Tarleton State University, and Tarrant County College

Education

• Ph.D. of Philosophy, Urban and Public Administration - University of Texas at Arlington, 1997

• Master of Public Administration - University of Texas at Arlington, 1991

• Bachelor of Biology - University of Texas at Arlington, 1983

• FBI National Academy graduate, 1996

• Senior Management Institute for Police graduate, 1999

• FBI Executive Institute graduate, 2002

Question: Which professional football player is the greatest of all time (GOAT)? Before someone says Tom Brady, let me tell you the correct answer is Earl Campbell. Having grown up in Houston, Texas, and watching him run, trust me. He also makes fantastic hotlinks. Okay, there could be some debate; his coach, Bum Philips, was once asked if Earl is in a class of his own, answering, “I don’t know if he’s in a class by himself, but I do know that when the class gets together, it sure don’t take long to call the roll.”

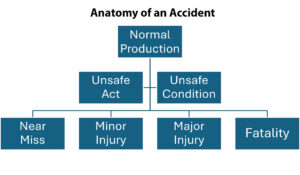

The GOAT is a topic of discussion in all walks of life, so what is the GOAT accident prevention principle? First, what is an accident? An unplanned event (extremely important since planned events are called insurance fraud) and an unforeseen event resulting in bodily injury and/or property damage.

Accidents occur at the intersection of normal production, unsafe conditions, and unsafe acts, resulting in one of four possible outcomes: a near miss, minor injury, major injury, or fatality. Failure to manage unsafe acts and/or unsafe conditions leaves the outcome to luck. Unsafe acts drive the bus! Depending on the expert, unsafe acts are the driver in 70-90% of all injuries in the workplace.

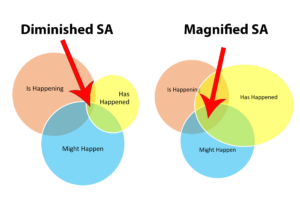

Unsafe acts are driven primarily by a lack of recognizing one’s surroundings – situational awareness (SA). SA comes down to three basic questions: what has happened in the past, what is happening right now, and what might happen in the immediate future – where those three questions coalesce is the home of SA.

Failure to grasp or ask any of those three questions diminishes one’s SA. If your employee doesn’t understand what has happened in the past, his SA is lessened! Conversely, employees who understand and ask those three questions have a heightened SA. An employee’s SA is directly proportional to their grasp of what has happened, what is happening, and what might happen in the immediate future.

For example, consider linemen who regularly working 45+ feet in the air. Fear of heights is the fourth greatest fear in America. Why? Because gravity sucks, and it always works. Linemen are fully aware of what could happen if they are suddenly no longer anchored to the pole, thus heightening their SA. BTW, an unanchored lineman 45’ in the air will make contact with the earth in 1.6725 seconds traveling at 36.69 mph.

Situational Awareness is the GOAT of accident prevention principles. Failure to grasp what has happened in the past, what is happening right now and what might happen in the immediate future puts you and your employees in a most precarious situation.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Ed Pratt

Director - Risk Services; Safety National

Summary of Qualifications

Certified safety professional with 43 years of experience

Responsibilities

Improve profitability by reducing customer's accident frequency and severity.

Business Experience

Forty-three years of experience working for multiple insurance carriers, including Safety National for 21 years.

Professional Affiliations

American Society of Safety Professionals (ASSP)

Education

B.A. Biology with a minor in Chemistry, University of Mary-Hardin Baylor

In 2024, high claims costs have resulted in a more limited insurance marketplace with reduced capacity and increased retentions and premiums. Public entities continue to face challenges with their accumulation of values in a broad range of properties, from historical buildings to jails and inherited properties. This can result in either insufficient coverage in the event of a loss or paying higher premiums than necessary.

However, the pace of overall property insurance rate increases is beginning to slow, and capacity is starting to improve. Rates are leveling out on some layers of coverage while increasing on others. Multiple insurance markets have announced an increase in capacity for 2024, and insureds with optimal risk profiles are in the best position to take advantage.

Trends to Watch

Adequate Valuations

To secure optimal (or sometimes any) coverage, public entities must focus on obtaining adequate valuations of their properties and assets. As today’s economic conditions are inflating property values, accurate valuations and claim recovery are top priorities. Surging natural disasters are also increasing property risks, especially for organizations without up-to-date insurance strategies.

More frequently than ever, underwriters are questioning the validity of values for fixed assets, such as buildings and vehicles. When underwriters are dissatisfied with valuations, they usually impose coverage restrictions. Some underwriters may even refuse to offer any coverage unless the values are adjusted to their satisfaction.

Insurance carriers use third-party data sources and internal tools to capture and assess values. However, relying solely on these tools without vetting the output can lead to negative results for insureds. Public entities should partner with a knowledgeable broker to conduct a thorough review based on the actual circumstances of their individual properties. This helps secure maximum coverage at the time of loss while minimizing premium expenses.

Sexual Abuse and Molestation (SAM) and Traumatic Brain Injury (TBI) Insurance

Public entities are particularly at risk for SAM and TBI liabilities, as they often serve children, students, and other vulnerable populations. As a result, insureds might need to purchase SAM and TBI policies from a secondary market, which can be expensive and limited in capacity. It’s crucial to implement effective risk management strategies and maintain a strong risk profile to obtain the necessary coverage.

Insurance Strategies

Public entities can implement effective strategies in a challenging market by:

- Preparing a comprehensive market submission that highlights a strong or improving safety culture and risk management approach.

- Developing analytics around risk financing opportunities that improve decision-making and outcomes.

- Using catastrophic property modeling to identify the appropriate amount of wind, flood, and earthquake coverage.

- Ensuring that construction, occupancy, protection, and exposure (COPE) data is detailed and accurate.

- Evaluating all U.S. and London market options, focusing on risk appetite and industry.

- Performing a cyber policy review to ensure an organization’s program includes current coverage updates and uses risk management tools to help navigate cyber exposures and claims.

- Addressing specific needs — for example, threat/terror solutions that offer a broad coverage option for strikes, riots, and civil commotion.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Anthony DiBernardino

National Public Entity & Education Vertical Leader; USI Insurance Services, LLC

Summary of Qualifications

Anthony is a partner and leads the USI National Public Entity and Education Practice. Anthony joined USI after 25 successful years with global insurance brokers and insurance companies. He has held various local, regional, and national positions leading clients, broking and industry verticals. His responsibilities included leadership of all aspects of the commercial lines business including sales, strategic account management and carrier relations. Anthony consults with senior executives to understand their organizations and develops solutions to various enterprise risk issues. He is an expert in alternative risk transfer products. Anthony also has extensive experience in the insurance brokerage industry including analytics, program design and coverage, project insurance, enterprise risk management, safety, and claims.

Education

B.A. Economics and Politics, St. Joseph's University

In this article, J. Brett Carruthers offers additional tips on minimizing conditions that might cause pipes to freeze. Click here for Part 1.

As winter begins its annual visit, this is the time to minimize the opportunities for conditions leading to freezing pipes and their subsequent rupture, damage and disruption.

Additional helpful tips

Cold weather is an equal-opportunity freezer. Both metal and plastic pipes will break when water freezes and expands.

- Keep thermostats above 60 degrees in areas that are poorly insulated. Every degree counts!

- Drain all pipes not in use or not used for fire protection.

- Check for pipe insulation in basements, crawl spaces, under stages, and other areas where pipes may be under-heated.

- Check for wet pipe insulation in the same locations. Wet insulation is an indication of an active leak and requires correction before a freezing condition occurs.

- Identify all water main valves and maintain clear access to them in case they must be closed quickly. Ensure closure devices are in place.

- Open doors from heated areas to unheated areas to keep pipes sufficiently warm.

- Take and monitor thermometer readings, especially on cold days, to help determine vulnerable areas.

- Check fresh air intakes (especially in boiler rooms) to ensure the louvers are not frozen open.

- Check to see if pipe sleeves and heat tapes are working.

Double-check vulnerable areas such as:

- Pipes running against exterior walls

- Outdoor hose bibs, pool or outdoor shower supply lines and sprinkler lines that run through unheated or uninsulated spaces

- Supply lines in garages or receiving areas

- Water lines in locker or team rooms

If you’ve had a pipe freeze in the past − or experienced a near miss − anticipate a repeat unless you’ve taken adequate preventive measures.

Be proactive over winter holidays and long weekends

The winter months have a host of extended breaks and long weekends. These are particularly worrisome because fewer staff are available to detect heat malfunctions, frozen or burst pipes, low thermostat settings or renovations and repairs that expose pipes.

Arrange for staff to check buildings during these breaks. Early detection can prevent significant damage and coinciding disruption to school operations.

Building management systems

Meet with your building management system (BMS) contact. Ensure temperature setbacks are not below 55 degrees. Ensure univents are programmed to increase heat if temperatures in the room fall below 55 degrees. Check boiler operating temperature set points to ensure they are compliant with the manufacturer’s specifications. Check other temperature parameters and sensors to ensure they are properly set for the change in seasons.

If your BMS provider has the capability to send critical alerts via text or email, ensure these are set to notify you of below 55-degree temperatures in rooms (in unoccupied state). This is also a great time to update your contact points with your automated BMS alerts (above) and EMS, police, and security companies to reflect personnel and contact number changes that may have occurred in the last year.

Loss of power

The loss of power is a leading cause of pipe freeze and pipe break losses. Buildings are without heat for an extended period leading to their freezing, rupturing and subsequent damage. Buildings without emergency power should have arrangements made for portable generators to provide emergency power to mission-critical equipment [heat plant, freezers, coolers, IT equipment, and building alarm systems]. Alternatively, provisions should be made for portable heating units to provide building heat while the building is without power.

Emergency generator checks

Emergency generators should be run weekly for at least 30 minutes and periodically under load to ensure they will start and can handle the load. They should receive preventive maintenance by a qualified firm semi-annually to ensure their reliability during emergencies. Staff should receive training in their operation.

For fueled generators, the fuel should be fresh, and the tank(s) topped off prior to cold weather setting in. There have been numerous instances of generators failing due to contaminated fuel. Stored fuel can accumulate algae, which can quickly plug fuel strainers and filters.

Capital Planning

In buildings without emergency power generation, this must become a priority need for upcoming capital projects. Protecting mission-critical equipment is essential.

Other Steps

If leaks occur, remove and discard water-damaged ceiling tiles, clean up the water as soon as possible, and utilize drying equipment (fans and dehumidifiers). Call a restoration company or flooring expert immediately If water gets on or underneath. It needs rapid attention to avoid a significant loss. When necessary, contact a restoration company for emergency mitigation services.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: J. Brett Carruthers, ASP, CSP, RSSP

Senior Vice President - Risk Management and NYSIR Director of Risk Management, Wright Public Entity

Summary of Qualifications

Brett is the senior vice president of risk management and director of innovation for Wright Public Entity, as well as director of risk management for the New York Schools Insurance Reciprocal. Brett counsels school administrators in methodologies to mitigate risk in school operations. He is an innovative thought leader and solutionist in public school risk management.

Brett has over 40 years of diverse safety and risk management experience. He is a graduate of Indiana University of Pennsylvania with a BS degree in safety sciences and a minor in human resource management. He is a professional member of the American Society of Safety Professionals serving in numerous elected leadership roles and a recipient of the prestigious Culberson Award for contributions to the Society. Brett is a fellow of the Los Angeles Council of Engineering and Scientists and an Edward J. Waring Lifetime Achievement Award recipient for his contributions to the safety profession by the Western New York Safety Council.

Responsibilities

Brett is responsible for all risk management program aspects for the NY Schools Insurance Reciprocal. He oversees the risk control team and the risk transfer team in their duties providing service to NYSIR's 345 members.

Business Experience

Brett is a safety and risk management professional with over 40 years of experience in both the public and private sectors. He has extensive experience in high risk construction, chemical process safety, municipal public sector safety/risk management and K-12 Public school safety/risk management.

Professional Affiliations

- American Society of Safety Professionals

- Board of Certified Safety Professionals

- Public Risk Management Association

Education

- B.S. Safety Science, Indiana University of PA

- Minor: Human Resource Management

Public mass shootings are horrific events that annually take innocent lives in the United States. Federal, state, and local governments, as well as educational institutions, need to propose and enact policies and strategies to protect people from and during active shooter situations. Public entities and public-sector organizations need to consider the best ways to protect people in their buildings from active shooter situations and how best to mitigate the risk of mass shootings.

A mass shooting is an incident of targeted violence carried out by one or more shooters at one or more public or populated locations. Multiple victims (both injuries and fatalities) are associated with the attack, and both the victims and location(s) are chosen either at random or for their symbolic value. The event occurs within a single 24-hour period, though most attacks typically last only a few minutes. The FBI defines an event in which one or more individuals are “actively engaged in killing or attempted to kill people in a populated area. Implicit in this definition is the shooter’s use of a firearm. United States statute (Investigative Assistance for Violent Crimes Act of 2012) defines a “mass killing” as “3 or more killings in a single incident.

Public agencies need to assess the risk in their workspaces as well as in the communities that they serve. Mitigation strategies should be developed and incorporated into emergency management and hazard management plans. Public entities and public-sector organizations need to consider the best ways to protect people in their buildings from active shooter situations and how best to mitigate the risk of mass shootings.

Items to consider:

- Implement a threat assessment team

- Develop an emergency action plan

- Create a crisis communication plan

- Train staff

- Drills and tabletop exercises

- Conduct site assessments

- Form community partnerships

- Restrict access

- Security officers

- Armed and/or unarmed

Statistical information can be found at https://rockinst.org/gun-violence/mass-shooting-factsheet/.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Sherri Adams, ARM, WCCA

Risk Manager, City of Kansas, Missouri

Since 2021, Sherri Adams has been the Risk Manager for the City of Kansas City, Missouri and manages safety, workers’ compensation, insurance programs, reviewing insurance requirements in contracts and other duties as assigned. Prior to her arrival in Kansas City, Ms. Adams worked for 17 years in California for both small and large counties, a third-party administrator and a transit district. Ms. Adams served on the Public Risk Innovation, Solutions and Management (PRISM) Board of Directors for over 13 years, with two years as a member of the Executive Committee. She also served on various committees including Risk Control, Member Services, Medical Malpractice and Claims Review. Ms. Adams is a graduate of San Jose State University with a Bachelor of Science in Business Administration in Marketing and has an Associate in Risk Management (ARM) as well as the Workers’ Compensation Certificate of Administration. (WCCA). Most recently, Sherri was recognized as the 2024 PRIMA Risk Manager of the Year.

First responders serve as the frontline managers of risk and safety in the public sector, responding in real time to worst-case scenarios across our communities 24 hours per day, every day of the year. The threats responded to by our police, firefighters, EMS professionals and 911 dispatchers include murders, suicides, high-risk domestic violence, environmental catastrophes, active shooters, mass evacuations and myriad other terrible realities most of us never confront firsthand.

Responding to these harsh realities leads to two interrelated types of risk. The first, Decision-Action Risk, captures the extent to which first responder decisions and actions mitigate the risk of the situations they respond to over time. The second, Wellness-Trauma Risk, captures the extent to which first responders are negatively affected over time by the stressful and traumatic aspects of the situations and scenarios to which they respond. Of course, Wellness-Trauma Risk, by undermining emotional stability and decision-making quality, directly aggravates Decision-Action Risk, which in turn fuels great Wellness-Trauma Risk. Both types of risk are the direct concern of risk managers, first responders, the public at large and any stakeholders concerned with mitigating risk or maintaining public safety. Research demonstrates that first responders are also suffering from an unsustainable degree of understaffing, further aggravating these risks. Fortunately, many solutions are available.

People Risk Management Solutions

First responders benefit substantially from high-quality peer support, or fellow first responders specially trained to provide support related to both work and non-work stressors. Because peer supporters are also first responders themselves, they are easy to access, capable of building trust, and relate effectively to the realities of the work. Research has shown that 90% of first responders who used peer support found it helpful, 80% reported they would seek assistance again and 90% said they would recommend the program to a peer (Digliani, 2018).

While peer support is a key part of the solution to managing Wellness-Trauma Risk, and in turn Decision-Action Risk, it is far from the entire solution.

Many challenges experienced by first responders routinely go beyond what can be resolved with peer support alone and must instead be referred to licensed clinicians qualified to treat post-traumatic stress, depression, suicidal thinking, and related mental health issues common amongst first responders. Many years of firsthand experience has taught us the critical importance of utilizing clinicians who are culturally competent (i.e., familiar with the realities of first responder work), effective (i.e., skilled at treatment), professional (i.e., ethical and law-abiding) and available (i.e., responsive when needed).

Technology Risk Management Solutions

First responder Wellness-Trauma Risk and Decision-Action Risk are challenges we face on a national scale, and therefore nationally scaled solutions are necessary to ensure consistent quality, accessibility and availability of support. Technology has become a vital key to addressing these challenges on a national scale. Examples of agencies implementing high-tech wellness solutions for their first responders include the Vacaville Police Department and the Memphis Police Department, and both agencies subsequently won the prestigious Destination Zero National Officer Safety and Wellness Awards, a testament to their innovation and leadership in implementing strong wellness programs designed to care for their personnel at scale.

Other examples of technology being utilized to address the Wellness-Trauma Risk and Decision-Action Risk include providing training and certification of peer supporters, training and certification of first responder clinicians, access to certified first responder peer supporters and clinicians, access to crisis support resources, a wide range of high-quality wellness self-help tools designed specifically for first responders, and in-hand, on-demand access to the full range of wellness tools and support resources available to first responders at any given public safety agency, regardless of the size of the agency.

Leadership Risk Management Solutions

Public safety agencies have experienced substantial leadership turnover in recent years. Fortunately, strong leadership training is available for first responders at mass scale. For example, retired Navy Seals and NYT best-selling authors Jocko Willink and Leif Babin recently co-created online training for first responders on topics including extreme ownership, leading up and down the chain of command and how to care for team members while also achieving the overall mission of your organization. Additionally, executive peer support for police chiefs and fire chiefs is now available to help ensure that leaders have access to the same level of support available to other first responders.

Conclusion: Large-Scale Challenges and Scalable Solutions

First responders nationwide face enormous challenges and stressors on a routine basis leading to Wellness-Trauma Risk and Decision-Action Risk, which should be a topline concern for anyone invested in upholding public safety. Fortunately, many scalable solutions now exist that can help address these challenges via training and certification programs, scalable technology applications, leadership development and peer support.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Dr. David Black, Ph.D.

President, Lexipol Wellness Solutions & Chief Psychologist, California Police Chiefs Assoc.

Summary of Qualification

Dr. Black has 20+ years serving first responders as a psychologist. He is

president of Lexipol Wellness Solutions, serving 2,000,000 professionals and more than 10,000 agencies nationally.

Dr. Black is the founder of Cordico and has served on working groups and committees for the International Association of Chiefs of Police, the National Police Foundation, the National Sheriffs Association, the National Fraternal Order of Police, and other associations to advance first responder wellness nationwide.

Responsibilities

Dr. Black's responsibilities include collaborating on wellness solution strategy and execution for public safety agencies across the United States, in addition to strategic partnerships, content development, recruitment, acquisitions, thought leadership, and speaking at conferences.

Business Experience

- Founder and CEO of Cordico Inc. (sold to Lexipol in 2020)

- Founder, CEO, and Chief Psychologist of Cordico Psychological Corporation (sold privately in 2022)

- President of Lexipol Wellness Solutions (Current)

- Lexipol Board of Directors (Current)

- 20 years of successful entrepreneurial business experience

Professional Affiliations

- Founding Member - National Sheriffs’ Association (NSA) Psychological Services Committee (2018 to Present)

- Advisory Board Member - National Police Foundation, Center for Mass Violence Response Studies (2019 to Present)

- Ethics Committee Member - International Association of Chiefs of Police (IACP), Police Psychological Services (2019 to 2023)

- National FOP Officer Wellness Committee and Provider Evaluation Subcommittee (2019 to Present)

- Member - International Association of Chiefs of Police (IACP), Police Psychological Services (2013 to Present)

- Committee Member - Psychological Fitness-for-Duty Evaluation Guidelines Revision Committee (2017-2018) International Association of Chiefs of Police (IACP) Police Psychological Services Section

- Committee Member - Officer-Involved Shootings Guidelines Revision Committee (2017-2018) International Association of Chiefs of Police (IACP) Police Psychological Services Section

- Member - Police and Public Safety Psychology Section, American Psychological Association

- Member - American Psychological Association (APA)

(2001 to Present)

Education

- Ph.D., Clinical Psychology (APA-Approved) - University of Georgia (2000)

- Pre-Doctoral Internship (APA-Approved) - Seattle Veterans Affairs Medical Center (1998-1999)

- Master of Science, Clinical Psychology - University of Georgia (1997)

- Bachelor of Science, Psychology, cum laude - University of Washington (1995)

- Bachelor of Arts, Philosophy, cum laude - University of Washington (1995)

The trees are bare. Mother Nature’s fury has started for winter. The clocks have been changed and with the additional hours of darkness, temperatures are now settling below freezing at night. As winter begins its annual visit, this is the time to minimize the opportunities for conditions leading to freezing pipes and their subsequent rupture, damage and disruption.

Water Damage Losses

Water damage losses are one of the most common losses during cold and freezing temperatures. These losses affect all areas of school buildings and create significant disruption to activities. Many of these losses are preventable with adequate pipe insulation, pipe tracing, heating system extensions, proper building management system setbacks and emergency generators.

Freezing and Bursting Pipe Basics

The time to start preparing is behind us. Being proactive now can keep your pipes warm and protected this winter. The following tips will prevent your pipes from freezing and keep water flowing this winter.

When pipes freeze, pressure builds and could result in them bursting at their weakest point, potentially causing water damage. Pipes in crawl spaces, exterior walls, team and locker rooms and outdoor hose bibs are particularly vulnerable, especially when they’re subjected to extra cold air.

We all know that freezing begins at 32° F, but at what point do pipes freeze within our buildings? Temperatures only need to drop to about 20° F for a few hours to put exposed pipes at risk. So, your best bet is to insulate your exposed pipes to keep that temperature well above the freezing point.

Best Practices to Keep Pipes from Freezing

The key to keeping your pipes away from freezing temperatures isn’t reaction - it’s preparation. Check out these tips on how to help you prevent the risk of your pipes even coming close to freezing temperatures.

Cover exposed pipes with insulation sleeves

Insulation sleeves, usually made of foam and are available at any building supply store, are inexpensive ways to surround your pipes with warmth and keep them from freezing in the cold temperatures. They’re affordable and easy to install, making them an excellent alternative to paying thousands of dollars to fix a frozen and burst pipe and its aftermath.

Seal cracks in the walls that let cold air in

A small wall crack that lets in a small account of cold air might not seem like a big deal but add all those little cracks together and you’ll find out that they’re costing you quite a bit of money on your heating bill and doing damage to your pipes, too. Seal cracks and openings around windows, doors, and at sill plates. Use weather stripping to stop the air from getting in and consider picking up a couple of draft stoppers for your doors to the outside. They’re both easy to install, help prevent your pipes from freezing and are even easier to remove come springtime.

Turn off and empty outdoor faucets

A pipe without water in it won’t be able to freeze or burst, so make sure you turn off any outdoor faucets. After shutting them off, open the faucet to drain any remaining water. While you’re at it, disconnect and store any hoses you might have left outdoors so they don’t become damaged by the freezing temperatures.

Pay attention to pipes in unheated or under heated areas of your buildings

Pipes in crawl spaces and basements run a higher risk of freezing than your main-level pipes, so make sure to take all tips into consideration and pay special attention to those areas.

Keep your garage and shop doors closed

Not only will closing your garage and shop doors keep critters from getting into your stuff, but it’ll also keep your garage or shop areas warmer and add an extra layer of protection to stop any pipes from freezing in these areas or along its walls.

Open interior faucets

If a cold snap is fast on the way and you don’t have time to take all the previous recommended steps, you can still help prevent frozen pipes with a simple turn of the faucet handle. Open your faucets just slightly to allow a small flow of water. Moving water is less likely to freeze, and it relieves excess pressure that builds if freezing does occur.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: J. Brett Carruthers, ASP, CSP, RSSP

Senior Vice President - Risk Management and NYSIR Director of Risk Management, Wright Public Entity

Summary of Qualifications

Brett is the senior vice president of risk management and director of innovation for Wright Public Entity, as well as director of risk management for the New York Schools Insurance Reciprocal. Brett counsels school administrators in methodologies to mitigate risk in school operations. He is an innovative thought leader and solutionist in public school risk management.

Brett has over 40 years of diverse safety and risk management experience. He is a graduate of Indiana University of Pennsylvania with a BS degree in safety sciences and a minor in human resource management. He is a professional member of the American Society of Safety Professionals serving in numerous elected leadership roles and a recipient of the prestigious Culberson Award for contributions to the Society. Brett is a fellow of the Los Angeles Council of Engineering and Scientists and an Edward J. Waring Lifetime Achievement Award recipient for his contributions to the safety profession by the Western New York Safety Council.

Responsibilities

Brett is responsible for all risk management program aspects for the NY Schools Insurance Reciprocal. He oversees the risk control team and the risk transfer team in their duties providing service to NYSIR's 345 members.

Business Experience

Brett is a safety and risk management professional with over 40 years of experience in both the public and private sectors. He has extensive experience in high risk construction, chemical process safety, municipal public sector safety/risk management and K-12 Public school safety/risk management.

Professional Affiliations

- American Society of Safety Professionals

- Board of Certified Safety Professionals

- Public Risk Management Association

Education

- B.S. Safety Science, Indiana University of PA

- Minor: Human Resource Management