Almost every week, media outlets report a new case of child sexual abuse taking place in a youth-serving organization setting. To better prepare your organization to prevent child sexual abuse, here are five things educational leaders should consider:

- There is no profile for a child sexual abuser. You cannot classify child sexual abusers by age, economic status, ethnicity/race, gender, marital status or sexual orientation, according to Child Sex Offenders Typologies (Simons, 2015). Therefore, anyone could be a child sexual abuser. By being aware that anyone could inflict harm upon minors while they are in the care, custody and control of a youth-serving organization, educational leaders can plan strategically to prevent incidences of abuse from occurring.

- Child sexual abusers work methodologically to gain access to or be near their preference without raising suspicion. Child sexual abusers may choose to work as custodians, IT professionals, photographers or security officers. Because there is no way to identify a child sexual abuser by appearance or any other variable outside of a criminal background check, child sexual abusers, who do not have a record of arrest or a conviction that would disqualify them from being hired, may already work at your organization.

- Child sexual abusers groom their preference to gain their trust to view their relationship as permissible and reciprocated (Groth,1983). It would behoove educational leaders to respond with caution when individuals responsible for working with minors begin to "blur the lines" between professional conduct and inappropriate behavior. Inappropriate behavior would include insisting youth address a caregiver as "grandma" or "uncle." This persistence to be addressed by a familial term rather than their name may cause minors to think the relationship with their caregiver is a personal relationship rather than one that should be professional.

- Child sexual abusers maintain very private personal lives. Most abusers experienced some form of abuse or neglect (emotional, physical, sexual) during their childhood and may have engaged in sexual activity with themselves, others or even animals at a young age (Simons et al., 2005). Because of their need to maintain their privacy, "child sexual abusers assault to alleviate anxiety, loneliness and depression" (Simons, 2015). Although a child sexual abuser may seem congenial and may even be considered a "team player," their coworkers and colleagues may not know much about them outside of the work setting.

- Child sexual abuse data and reporting often appear inconsistent. The reason for this disparity is that the National Child Abuse and Neglect Data System (NCANDS) only tracks child abuse and neglect inflicted by caregivers in the home (parents, household members), while incidences of child maltreatment by out-of-home caregivers fall under state and local law enforcement. Those data systems are handled and monitored by separate entities and do not necessarily provide a complete perspective of child abuse and neglect.

Effective youth protection systems help educational leaders increase awareness of child abuse and neglect within youth-serving organizations. In addition, effective youth protection systems enhance reporting procedures, which is key to preventing child sexual abuse.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Joaquina Scott Kankam, Ph.D.

Director and Senior Consultant, School of Solutions

Summary of Qualifications

Joaquina Scott Kankam, Ph.D., is the director of School of Solutions, a consultancy specializing in youth protection. Not only is Joaquina an expert in youth protection compliance and risk management, but her practical experience has made her a leader in understanding the needs of youth-serving organizations.

Joaquina has worked in education for almost twenty years to improve the lives of others. In addition to being an educator (K-12 & Higher Education), Joaquina has presented at several national association conferences and participated as a panelist in several discussions regarding youth.

Responsibilities

Dr. Scott Kankam works nationally to assist youth-serving organizations with protecting minors from abuse and neglect. She helps to create a better tomorrow by auditing and enhancing youth protection policies and policies.

Business Experience

Dr. Scott Kankam's experience includes enhancing and creating an awareness of the Six Effective Practices of the Youth Protection Enterprise Risk Management System®. The Youth Protection ERM System® identifies unknown and uncontrolled risks associated with hosting, operating or sponsoring programs for minors.

One of the few silver linings behind the COVID pandemic cloud is that it has drawn attention to the prevalence of mental/behavioral health (MH) challenges, and particularly to their importance in a work context. In The Hartford’s survey of employers and employees over the first three “waves” of the pandemic, employers reported that MH issues among their employees had increased from 56% in wave 1 to 69% in wave 3. Over half (59%) of employees reported that the culture of their company had become more accepting of MH challenges. Among employers, 50% agreed that employees' MH “always or almost always” impacted their productivity, and 80% felt they had become more accepting. [1]

MH conditions in the aggregate rank among the costliest disorders, whether taken on their own,[2] or as co-morbid conditions. For example, The presence of co-morbid depressive symptoms in workers on benefit due to musculoskeletal disorders increases both the number of days on compensation benefits,[3] as well as the number of treatment days.[4] In the California workers' compensation system in 2018, psychoactive medications accounted for 8.3% of all prescriptions,[5] and having these prescribed was associated with an additional $22K in medical cost and $51K in total claim cost, respectively. [6]

What to do? A multi-pronged strategy is suggested: effective mitigating interventions can be introduced on a continuum at various points in an unfolding MH episode.

- Intervene preemptively, if possible: Studies show that even simply providing helpful information to people requesting an FMLA for MH reasons impacts both leave duration and migration to STD. [7]

- Intervene as early as possible. The ADAAA interactive process mandate can be your friend. Potential MH claims can often be avoided/mitigated by making use of the ADAAA. Accommodations for MH are often surprisingly simple (hint: Ask the employee what would help).

- Intervene smartly. Using dedicated MH clinicians on these claims facilitates partnership with treaters. With dedicated MH staff, we averaged 10.71 fewer days per claim in 2019, per our internal data.

- Intervene continuously: Embed MH in the health/wellness plan.

- Intervene for recovery: Psychotherapy is cost-effective. Implementing outpatient psychotherapy coverage under insurance in Germany yielded significant reductions in work disability days (41.8%), hospitalization days (27.4%) and inpatient costs (21.5%) for the first year, and further decreases in the second year (23.8%). [8]

- Intervene for retention. Support from the employer is crucial. Satisfaction with the treatment of a workers' compensation claim by the employer has a huge impact: An increase in worker satisfaction (from Satisfied to Very Satisfied) can reduce claim cost by almost 30%.[9] Workers who are happy with their employers want to get back to work ASAP.

[1] The Hartford Study: Majority Of Employers Recognize Employee MH As A Significant Workplace Issue, Report Stigma Prevents Treatment | The Hartford

[2] Roehrig, C. Mental Disorders Top The List Of The Most Costly Conditions In The United States: $201 Billion. Health Affairs, 2016, 35, 6. https://www.healthaffairs.org/doi/full/10.1377/hlthaff.2015.1659

[3] Lötters, F., et al. The prognostic value of depressive symptoms, … Occup Environ Med 2006;63:794–801. doi: 10.1136/oem.2005.020420

[4] Lacroix, J.M. MH Claims in WC and Disability. WorkCompWire, March 16, 2021

[5] Young B & Hayes S. California WCI Research Update. https://www.cwci.org/document.php?file=4190.pdf

[6] Hunt D et al. Association of opioid, anti-depressant, and benzodiazepines with WC costs. J Occ Env Med, 2019: 61(5):e206–e211. doi: 10.1097/JOM.0000000000001585

[7] Spallone, A., & Lacroix, J.M. Managing MH claims proactively. CLM magazine, October 2020, Pp. 29-31.

[8] Altmann U, et al. Outpatient Psychotherapy Reduces Health-Care Costs: A Study of 22,294 Insurants over 5 Years. Front Psychiatry. 2016; 7: 98. doi: 10.3389/fpsyt.2016.00098

[9] Butler RJ & Johnson WJ Loss reduction through worker satisfaction: The case of WC. Risk Management and Insurance Review, 2011: 14, 1-26

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Dr. Michael Lacroix

Medical Director, The Hartford

Summary of Qualifications

Dr. Lacroix is medical director with The Hartford. He is a licensed psychologist in Florida. He has worked in the overlapping areas of disability and workers’ compensation for the last 30 years, in a variety of clinical, management, program development and consulting roles. Prior to joining the corporate world, (Concentra, then Coventry, then Aetna, and now The Hartford) Dr. Lacroix held academic appointments and developed a large clinical practice focused on assessment, treatment and rehabilitation of injured and disabled workers. He also carried out grant-supported research over many years, resulting in over 100 peer-reviewed publications and papers. He is a frequent contributor at industry conferences and publications.

Responsibilities

- Clinical review of complex psychological cases

- Staff education

- Program development

- Research

- Thought leadership (publications, conference presentations board memberships)

- General advisory functions related to behavioral health

Business Experience

- 2018 - present: Medical Director, The Hartford

- 2013 - 2017: Associate Medical Director, Aetna Disability

- 2002 - 2017: Director, Behavioral Health Services, Coventry Workers’ Comp Services

- 2000 – 2001: Regional Training Manager, East Region, Concentra Managed Care, Inc.

- 1998 - 2000: Regional Manager / Canada, Concentra Managed Care, Inc.

- 1981 - 1998: CEO and Chief Psychologist, Lacroix, Scher Consultants. Grew private practice into multi-million dollar psychological – vocational practice and ancillary businesses

- 1988 – 1998 Chief Psychologist, and Senior Psychological Consultant, West Park Hospital

- 1978 - 1989 Clinical and Research Consultant to Psychology Department, Ontario W.C.B.’s Downsview Rehabilitation Centre

- 1974 - 1991 Lecturer, promoted to Assistant Professor, then to tenured Associate Professor of Psychology, York University, Toronto, Ontario

Professional Affiliations

- American Psychological Association

- International Critical Incident Stress Foundation

- Licensed Psychologist: FL license PY6750

It’s my first day on the job as the new municipal risk manager. I am excited for sure, but then I realize that the “Culture of Risk Management” is nearly absent. My excitement dwindled to an anxiety of how in the world can I turn around this very large ship of “that’s not my job," to a team of, “I am the risk manager.”

My first advice is to assess where you are now. Do employees know how and when they should report incidents and accidents? Do employees actually follow that procedure? Is compliance training up to speed? Are policies in place that support my organization’s goals and objectives? Are incidents and accidents reviewed by peers and then the message of prevention shared? How is risk management viewed by my supervisor, directors and the employees at large? Maybe the most important question is: who do the employees think the risk manager is?

Other signs a risk management culture was seriously lacking was also obvious; a high experience modification factor, a number of frequent flier claims, late reporting of incidents and accidents, a lack of near miss reporting and a view that risk management was... over there somewhere.

And so it began. I had to slow down and recognize that this is a 3-5 year change process.

I first had to start with what is most important and will have the largest positive impact with the least amount of resistance. Small wins early on build credibility and foster inclusion of risk management.

I have come to learn that the secret to building a positive culture is - - you guessed it - -- people. Begin by sitting down with directors and key leadership to talk about risk management. Find out what they believe it has been, what they see it as today and how they envision risk management in the future. To be clear, this meeting is NOT about risk management, but about building the foundation of a working relationship and teamwork with the organization’s leadership. The side benefit is you will get to learn about their department and to educate them on how, when and where risk management can help them meet their objectives. At the same time, invest a few hours every month in “ride alongs” with the employees on the ground…police, fire, sanitation, public works and other departments you serve. Always keep in mind that to achieve desired results, you must have the support of the employees or progress will be severely impaired.

Then, policies need to be current and in place to provide direction to the employees and to assist in meeting the organization’s goals. Remember, small steps. This is a 3-5 year plan of teamwork. Networking and a series of small wins is the course.

Reporting of incidents and accidents is also most critical. Make your reports short and easy to understand in a form that can be easily emailed. When I first arrived at my entity, the ONE and ONLY report form was 13 pages long and contained sections that seemed to duplicate each other. A large percentage of time the reports were not completed, nor sent to risk management promptly, or at all. The structure today is outlined in a how-to manual broken into specific loss sections. The instructions are on one page and the corresponding report form is one or two pages long. The objective is to be in the loop as soon as is practical and making it easy for employees to make that happen.

When a new training program is first designed, polished and ready to roll, the first audience is the department director. After review, look for input into making changes, adds, deletes and most importantly, ask the key questions.

We professional risk managers are really risk consultants. Our role is to grow and nurture employees to understand their role as risk manager and encourage concepts like, “Stop Work Authority," “I am the Risk Manager," and “My Voice Matters,” to move the needle to a culture of risk management.

I did not realize how far we had moved the needle until one day, in a large auditorium filled with employees, I approached the podium and asked a question. “So, who is the risk manager?” Over the background music the resounding reply of hundreds of employees was “I AM." It brought a tear to my eye, for in that moment I realized we were there.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Dean Coughenour, ARM

Risk Manager, City of Flagstaff, AZ

Dean is the risk manager for the City of Flagstaff and directs their Risk Management Department, managing a comprehensive risk and safety program that includes reducing risk factors, grass root integration of the risk management decision matrix, safety, insurance, litigation management, workers' compensation, training, and facility inspection programs. Dean has over 30 years’ experience in proactive risk management and has served on various boards and associations including Arizona Municipal Risk Retention board and City of Scottsdale Loss Trust Fund board. He is also a past national board member of PERI (Public Entity Risk and Insurance), past loss trust fund board chair for the City of Scottsdale, past president of PRIMA National and has held various other community leadership positions. He is a frequent speaker on risk management topics both at national and local conferences. Dean serves on PRIMA's national speakers bureau and is a champion for risk management and the employment of the risk management decision matrix in day-to-day operations of public sector entities.

The public focus has been heightened on law enforcement operations resulting in additional policies and procedures, as well as increased emphasis during training and implementation. For example, De-Escalation Techniques and Duty to Intervene policies are critical not only for street operations but also for jails and lock-ups. We must remember not only to de-escalate detainees in difficult and tense situations but ourselves as well.

Additionally, four key issues lead to the majority of losses in jails:

- Medical Care: An overwhelming percentage of losses (43%), both number and monetary, results from failure to provide medical care, as shown from aggregated losses over 7 years. This is the largest area of exposure that a public entity can have. Individuals in custody are under the care of those managing the detention facility 24/7, including their healthcare. If staff neglect to take care of detainees’ medical needs, their issues could get worse, and they could become seriously ill or die. Liability increases if these issues were noted during the initial medical evaluation but were neglected to be addressed, if the detainee asked for help and never received it, or did not receive help within a reasonable time frame. Focused management of medical services and in-house response procedures are critical to reducing unnecessary suffering, fatalities, claims, and lawsuits. It should be ensured that appropriate hold harmless and indemnification language is incorporated into all medical contracts. Always have contracts reviewed by qualified local counsel. Further, it should be ensured that proper resources and supplies are available so detainees can maintain acceptable levels of hygiene.

- Poor Conditions: Regarding jail conditions, sometimes a facility is older or has issues beyond what the entity can solve expediently, but good jail management and treatment of detainees can make a positive difference. Facility reviews (formal and daily) with documentation and plans for improvement with documented updates are important, but even more key is working with the detainees by establishing a good rapport and by working to make the best of a less than ideal situation. An example of this would be providing daily buckets of ice and fresh washcloths to detainees when the air conditioning is broken or non-existent.

- Suicides: Suicide prevention begins at the time that the detainee is taken into custody and is brought to the jail/lock-up. Good communication should exist between the booking/transporting officer and jail/lock-up intake personnel. Proper assessments and monitoring practices should be in place, following established Standard Operating Procedures (SOPs). If detainees are on suicide watch, then they should be visually observed in their cell about every 15 minutes in addition to any video surveillance. The corrections officer should also periodically alter the routine, for example, by occasionally returning in a few minutes after checking on the detainee in order to maintain uncertainty of observation times with detainees. Any visit to the cell should be documented. Remember that key events can trigger suicidal attempts, such as the shock of being arrested, court dates/sentencing, upcoming facility transfer, and receiving visitors or bad news.

- Sexual and Physical Assaults: Although physical and sexual assaults account for a fewer number of losses, they incur considerably higher monetary expenses, following that of medical care claims. Sexual and physical assaults against detainees have been and are currently being committed both by staff and by detainees. These incidents can be reduced by implementing procedures for careful observation of detainees, including using large video display screens with good camera systems. Furthermore, staff should establish good SOPs incorporating the Prison Rape Elimination Act (PREA), as well as annual training with documentation and continuous awareness for prevention.

- Jail and lock-up operations present unique challenges, but they must be well-operated for employees, detainees, and communities. To those who serve the public, thank you for all that you do!

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Ashley Bonner

Senior Risk Control Consultant, Trident Public Risk Solutions, Member Paragon Insurance Holdings

Summary of Qualifications

Ashley has a BA from the University of Mississippi, with additional studies at L’Université de Tours in France, Xavier University, Delgado College for Occupational Safety & Health, and Tulane University’s master’s program for industrial safety & public health. She is also Six Sigma and WSO-CST certified.

Responsibilities

Ashley is responsible for risk management/evaluation services for a national territory of public entity insureds, including cities, schools, counties, law enforcement/jail operations, water treatment plants, waste haulers and utilities. She oversees development of the company risk management program, services and products, including as a profit center. She is also in charge of staff management, with direct experience in recruiting and hiring personnel, terminating employment and behavior coaching. Ashley is the facilitator for broker/agent relationships and other vendor relationships as well as an advisory source for training underwriters and staff. She is also responsible for development of client risk management guidelines and resources.

Business Experience

Ashley has over 30 years of safety and risk management experience with over 25 years being devoted to working exclusively with governmental operations.

ERM Experience

Ashley is a consultant and resource for public entities for education, planning and implementing ERM. She is a regular speaker on ERM for state chapter PRIMA organizations and author of articles for various organizations.

Professional Affiliations

- World Safety Organization

- Society for Human Resource Management

- PRIMA

- GA PRIMA

- NC PRIMA

- ASSP

Educational service districts in Washington state support and provide services to school districts

in designated regions across the state. Here at North Central ESD, we walk alongside 29 public school districts, which includes creating opportunities for engagement around employee safety.

Oftentimes, focus is set on the fund balance of a workers’ compensation pool. We lose sight of the importance of preventing incidents/claims from occurring in the first place and the overall impact that can have on the fund balance. Our workers’ compensation pool is governed by an executive committee of district superintendents, and in 2018 we proposed a safety incentive program which would rebate back to districts a percentage of their premiums when they partnered with us.

Why an incentive program? A couple of years ago we realized we had an opportunity not only to reduce the highest frequency and severity of our claims but engage, connect and assist our members in the overall safety of their school buildings.

What was the objective of this program? The main objective was for us to keep the program simple, make sure we did the heavy lifting for our districts, and build deep relationships so they would see the overall benefit of this program and ultimately reduce slip, trip and fall claims. Now in our third year (we suspended it during COVID) we have seen what a positive impact this incentive program has made in our districts.

How does the program work? The initial program included multiple walkthroughs of district buildings throughout the year to look for “hazards” as well as a compliance piece that focused on safety committees. We developed an assessment tool to be used during each walkthrough, and as long as the cumulative score is above the set amount, the districts are eligible for the incentive dollars.

How do districts spend their incentive dollars? Our only request is that they use the money for staff-related safety items for their buildings. It is up to the district to determine the best way to utilize these funds.

How do we measure the success of this program? That part is pretty easy! We have seen a reduction in claims being filed, and one of the largest wins was the reaction of the schools’ board of directors when we presented their incentive checks at board meetings. It was not about the amount of money they were receiving, but the opportunity to share positive news and recognize their staff.

Overall, thinking outside of the box when it came to incentivizing our workers’ compensation pool has helped our agency actualize our philosophy of weaving safety into the culture of a business while we walk alongside our district members, helping them get to where they want to be, at the pace they want to go.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Suzanne Reister

Executive Director HR, Workers' Comp, Unemployment, North Central Educational Service District

Responsibilities

Suzanne is responsible for the day to day operations for North Central ESD's workers' comp pool as well as their unemployment pool. She manages and directs strategic goals, risk management services, budgets, contracts and arrangements with third party administrators. Suzanne works closely with 29 districts to manage and control claims. She is also responsible for monitoring all expenses, proposing annual budgets, hiring staff and maintaining a healthy fund balance.

Business Experience

Suzanne has 20 years' experience in private industry managing the business side of up to five franchise businessess, marketing, payroll and all aspects of accounting. She has 19 years with North Central ESD with current experience in self-insured pools, human resources and other programs.

Professional Affiliations

Public Risk Management Association (PRIMA)

Society for Human Resource Management (SHRM)

Washington School Personnel Association (WSPA)

Education

ARM-P, PHR and SHRM-CP designations

Risk Management for Smart Cities

Perhaps the largest looming risk in smart cities is the increase in systems that rely on connectivity. The last few years have shown us that public entities are not exempt from cybercrime. In fact, cities and municipalities seem to be prominent targets. Over 100 state and local governments were attacked by ransomware in 2019 alone,[1] with the damage ranging from a handful of employee computers to widespread loss of data and payment systems. The costs of these attacks also vary greatly from a couple hundred to tens of millions of dollars, with some cities opting to pay the criminals’ ransom demands and others racking up fees to recover data and rebuild systems.

In 2018, the city of Atlanta unfortunately became a prominent example of the damage these attacks can incur. The city no longer had the ability to use online payment systems and years of police dashcam footage was lost, some of which was earmarked as evidence in ongoing trials. One report estimated the cost at $17 million to rebuild and replace the systems that were lost and mitigate future vulnerabilities.[2] While this is certainly on the high end of prospective costs, it’s clear to see that even a fraction of this cost could seriously cripple a smaller municipality if not properly insured.

The cyberattacks to date have generally taken out rudimentary technology, yet they have created large disruptions. Now imagine a world where an attack halts all common payment systems, reprograms connected traffic signals, or disables automated shuttle routes. This could be catastrophic when it comes to business interruption, and it could also pose legitimate safety concerns for the commuters in the city.

The potential downsides of these technological advancements seem daunting, but keep in mind that resilience is forged through progress. The current success of cybercriminals can be partially attributed to a lack of preparation on the part of city planners and risk managers alike. Implementing new smart systems brings about the opportunity to reassess the current approach to cybersecurity and places a renewed importance on protecting the systems that run a city, as well as the residents who rely on them. For this reason, increasing the amount of connected things will not necessarily lead to a proportionate increase in exposure and insurance costs, due to the offsetting nature of better cyber protection.

As cities become smarter, forming a risk management plan that focuses on risk avoidance, mitigation, transfer, and tolerance will become more challenging. The focus should not be on finding that perfect balance, but rather having a well thought out plan in the first place. Risk managers should be brought to the table as cities look to become smarter. The allocation of resources to preventive versus reactive measures needs to be discussed collaboratively to provide the utmost risk management flexibility.

“Smart cities” will need “smart” risk managers, which is why risk management collaboration should not end there. Determining the amount of risk to insure and self-insure will be difficult without the expertise of brokers, actuaries, IT professionals, and other risk managers, not to mention the engineers developing and testing this smart technology. Continue to seek opportunities to educate yourself on these emerging risks and build your risk management strategies today as your city plans for tomorrow.

[1] Recorded Future (December 20, 2019). State and Local Government Ransomware Attacks Surpass 100 for 2019. Retrieved October 5, 2021, from https://www.recordedfuture.com/state-local-government-ransomware-attacks-2019/.

[2] Deere, S. (August 1, 2018). Confidential Report: Atlanta’s cyber attack could cost taxpayers $17 million. Atlanta Journal-Constitution. Retrieved October 5, 2021, from https://www.ajc.com/news/confidential-report-atlanta-cyber-attack-could-hit-million/GAljmndAF3EQdVWlMcXS0K/.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Drew Groth, ACAS, MAAA

Associate Actuary, Milliman

Drew is an associate actuary in the Milliman Milwaukee office with expertise in predictive modeling, ratemaking and loss reserving. He has experience in varying lines of business including workers' compensation, personal lines and commercial auto, with clients ranging from self-insured corporations to large insurance providers. Drew also has experience working on projects with start-up companies where out of the box thinking is required to craft customized solutions. Through his diverse experience at Milliman, he has developed a passion for autonomous vehicle technology with respect to risk management and insurance, especially as it concerns commercial uses.

By: Jonathan Riehl, PhD, PE

Transportation Systems Engineer, University of Wisconsin-Madison

Jon is a transportation systems engineer in the Traffic Operations and Safety Lab at the University of Wisconsin-Madison and helps manage the Wisconsin Automated Vehicle Proving Grounds, including the Park Street Connected Corridor and the automated shuttle program. His work responsibilities include research in transportation systems management and operations (TSM & O), connected and automated vehicles and geographic information systems (GIS), and teaching. Jon holds a PhD in civil engineering from Michigan Tech and has master’s degrees in electrical engineering, geography, and business.

Introduction

In the past decade, more cities have been focusing on advanced infrastructure to improve public services. The objective is to make the city services operate more efficiently and safely for all residents and visitors, and to be more equitable for citizens who have traditionally been underserved.

Smart infrastructure systems have the potential to make cities better places to live and more efficient. They also create many new scenarios requiring public risk managers to step into the unknown and develop novel risk management strategies.

Smart City Infrastructure

Smart city infrastructure is a broad term referring to a range of projects, usually centering around the use of a specific technology to support roads, buildings, parking, utilities, and other city-managed systems. Smart city infrastructure includes:

- Smart data platforms: Open-source data platforms incorporating smart city data for development of third-party applications (e.g., live bus location updates). These platforms serve as the basis for many other smart infrastructure systems.

- Traffic and transportation management centers: Centralized locations where all transportation feeds are processed, usually utilizing an array of displays to monitor traffic operations.

- Dynamic traffic signal timing: Traffic signals that utilize methods to measure current traffic flows and adapt to provide more green-light time and optimize travel for platoons of vehicles through a corridor.

- Connected traffic signal systems: Traffic signals that have a form of wireless communication and are able to communicate directly with surrounding vehicles to optimize traffic flow and exchange safety information (e.g., red-light runner warnings, pedestrian in crosswalk warnings, etc.).

- City vehicle route optimization: Optimizing routes and schedules for city vehicles such as trash pickup, street cleaners, or snowplows.

- Mobility-as-a-service (MaaS): Seamless integration of all transportation modes on a common platform to allow point-to-point booking using multiple transportation services to get people to places faster, cheaper, and/or more efficiently. Trips can be paid for individually or through a subscription model. MaaS includes common payment systems and touchless fare collection.

- Smart mobility hubs: Strategically located transportation centers within the metro area with access to multiple modes of transit including buses, light rail, bikes, and scooters.

- Micromobility: Lightweight, low-speed, personal vehicles to allow for fast transportation to destinations over a few blocks away and up to a few miles. These vehicles include bike shares, e-bikes, electric scooters, and mopeds.

- Automated shuttle services: Automated shuttles can be deployed in traditionally underserved areas of the city to provide dynamic routes that connect to the larger transit systems and serve neighborhoods all hours of the day. Other areas for automated shuttle use include campus routes, first-last mile links, and local deliveries.

- Smart streetlighting: Streetlights that are connected to the city’s management center that can be set to automatically turn on and off and sense pedestrian presence to turn on when needed.

- Curb-space management: Treating curb space as the valuable asset that it is, these systems charge for use of the curb space based on time of day, location, vehicle size, and vehicle classification.

- Smart parking garages and spaces: Parking garages that can automatically count spaces available and relay this information to potential parkers. Specific spots can be found and/or reserved through more advanced systems.

The risk management implications of this infrastructure will be discussed in Part 2...

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Drew Groth, ACAS, MAAA

Associate Actuary, Milliman

Drew is an associate actuary in the Milliman Milwaukee office with expertise in predictive modeling, ratemaking and loss reserving. He has experience in varying lines of business including workers' compensation, personal lines and commercial auto, with clients ranging from self-insured corporations to large insurance providers. Drew also has experience working on projects with start-up companies where out of the box thinking is required to craft customized solutions. Through his diverse experience at Milliman, he has developed a passion for autonomous vehicle technology with respect to risk management and insurance, especially as it concerns commercial uses.

By: Jonathan Riehl, PhD, PE

Transportation Systems Engineer, University of Wisconsin-Madison

Jon is a transportation systems engineer in the Traffic Operations and Safety Lab at the University of Wisconsin-Madison and helps manage the Wisconsin Automated Vehicle Proving Grounds, including the Park Street Connected Corridor and the automated shuttle program. His work responsibilities include research in transportation systems management and operations (TSM & O), connected and automated vehicles and geographic information systems (GIS), and teaching. Jon holds a PhD in civil engineering from Michigan Tech and has master’s degrees in electrical engineering, geography, and business.

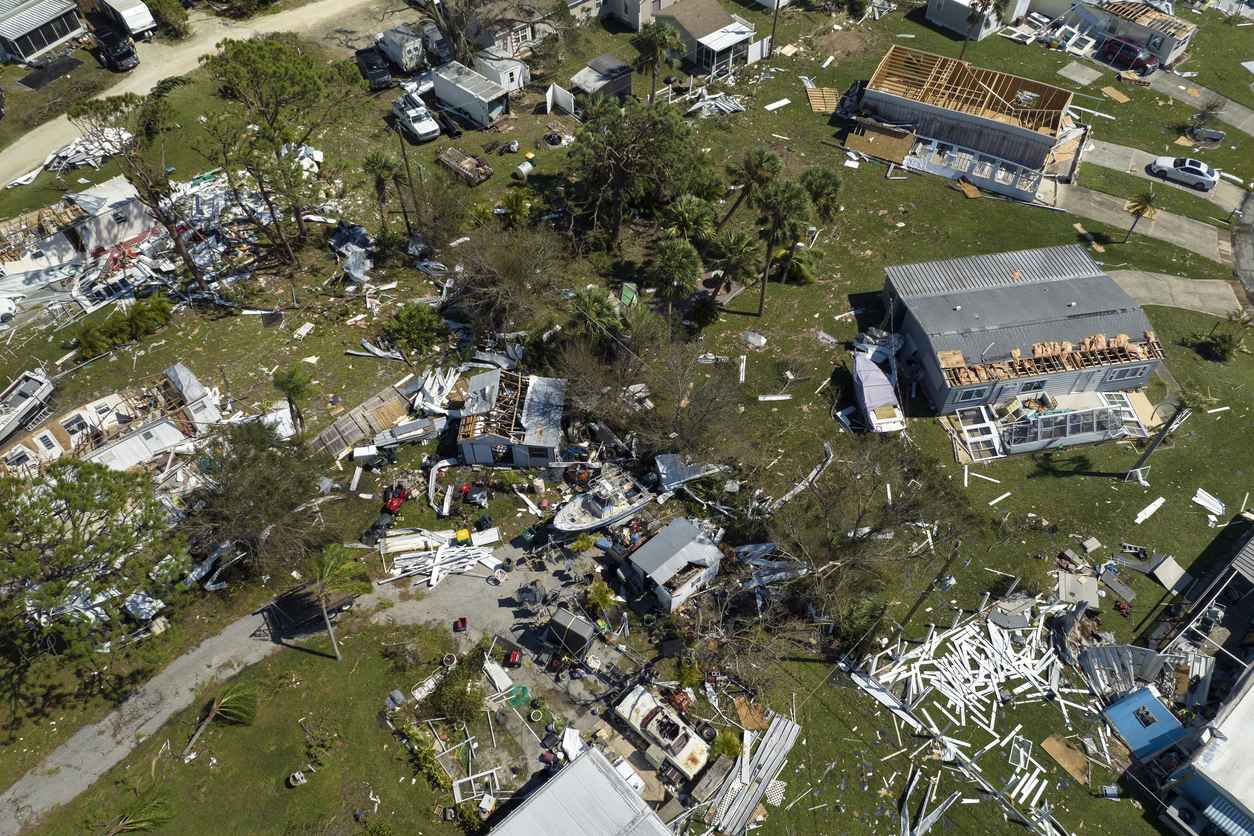

Transparency is a key component in any relationship. In almost every instance, the more one knows and understand about the object of that relationship, the better off they are in the long run. When applying transparency to property insurance the same is true. The more transparency an insured can provide, the better the insurance marketplace can understand the exposure, extend appropriate terms and price the coverage accordingly.

Property underwriting data’s relevance has grown exponentially. Understanding the relationship between data, insurance terms and cost is vital when developing a best in class property submission, especially in a hard property market. Property underwriters use your property data, predictive analytics and technology platforms to determine how your property might perform when exposed to the perils you are looking to insure. Modeling enables an underwriter to weigh predictability against uncertainty to calculate the cost of insuring property for the covered peril. In today’s marketplace, greater uncertainty typically equates to lesser coverage terms and greater cost.

Historically, robust data was typically required for property exposed to higher risks like earthquakes and hurricanes. Now in many instances this is no longer the case. Climate change and more severe weather patterns bring into play additional perils like inland flood, winter / convective storms and wildfires that require additional exposure data to analyze risk properly (https://www.businessinsurance.com/article/20210817/NEWS06/912343906/Property-insurers-tighten-coverage-as-climate-change-continues) As insurers look to catastrophe modeling firms for more information to help address climate change, the subset of secondary property and exposure data that these models require is quickly becoming more relevant.

While there are a number of things that comprise a best in class property submission like claims data and engineering information, robust, well organized property data can make a significant difference in how insurance carriers analyze, extend terms and price your risk. When setting out to collect and organize your property data here are some things to keep in mind:

- Ask your insurance professional what data you need. Remember it is the quality of your data not the quantity that matters. Data collection efforts should focus on data that will provide an insurer with a transparent understanding of your property. Often, risk managers are under the impression that the more data they collect, the better off they will be. This can often lead to collecting an overabundance of exposure data that has little or no impact on the cost and terms and increases to the cost of the data collection effort.

- Develop a plan. Property data collection shouldn’t be a one-time event. Think of it as a program not project. Develop a systematic program for collecting and keeping your data current. Create a narrative around your program to include how data is collected, managed and updated. Your plan should result in a program that provides a comprehensive overview and supporting data for the property you want to insure. Remember, transparency about your program bolsters credibility and fosters great long term relationships with insurance carriers because they can understand the risk.

- Set realistic goals. Once you know what you need for your program, be realistic about how to meet your objectives. If you have internal resources to manage your program, make sure they understand the plan and can execute it in a timely manner. If you do not have the resources or expertise, consider engaging a professional firm to manage the program for your organization. Outsourcing to a professional valuation or consulting firm can typically deliver program cost management and the resources required to successfully implement and manage your program.

- Weigh the costs. An ounce of prevention is worth a pound of cure. The cost of a good property data program is miniscule when compared to property premiums. A well administered program and a best in class property submission, place your organization and your broker in the position to negotiate advantageous cost and terms for property coverage year after year.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Ron Acebal

National Director, CBIZ Valuation Group

Summary of Qualifications

Ron is a national director for the Tangible Asset Practice of CBIZ Valuation Group. His consulting expertise includes consultative development and implementation of property valuation and data aggregation solutions for risk management and property cost accounting requirements. Ron's primary focus is on large property risk sharing consortiums in addition to Fortune 1000 companies, captives, religious institutions, commercial insurance/brokers carriers, healthcare institutions, reinsurance intermediaries and private industry.

Responsibilities

Ron has been frequently invited to present at national statewide and regional professional association conferences to address the topics of property cost accounting, insurance valuation and data aggregation and collection. Some of the associations he has presented to include the Public Risk Management Association, Massachusetts Municipal Auditors’ & Accountants’ Association, Midwest Higher Education Compact Property Program, Maryland Municipal League, Association of School Business Officials International, The New York State Association of School Business Officials, The New York State Government Finance Officers’ Association, New Jersey Association of School Business Officials, Florida PRIMA, South Carolina PRIMA and others. In addition to presenting to these organizations, Ron has also authored articles dealing with property insurance appraisal, property cost accounting and the importance of property exposure data for various publications and association newsletters.

Ron has over 25 years of valuation consulting experience with a number of national appraisal firms. Prior to joining CBIZ Valuation Group he was a vice president with a national property valuation practice where his responsibilities included consulting, business development, contract management and project planning.

Business Experience

Ron has significant experience with the consulting, implementation of, and management of property valuation programs for property for national, statewide and regional risk sharing consortiums. This experience includes organizing and coordinating underwriting and data collection requirements, coordinating work product / deliverables, budget development, contractual administration and providing various types of marketing and educational support services to these types of organizations.

Professional Affiliations

In addition to presenting for a number organizations, Ron has also authored articles dealing with property insurance appraisal, property cost accounting and the importance of property exposure data for various publications and association newsletters.

An effective government solicitation requires a great deal of effort. Whether it is an Invitation for Bid (IFB) or a Request for Proposal (RFP), comprehensive government agency solicitations allow for knowledgeable purchasing decisions. Many agencies which are understaffed and overworked, create an environment which may tempt employees to accelerate through the solicitation process; but it is advisable not to do so. A sound solicitation, with an accompanying sound evaluation process, will not only help your agency identify the right vendor and service or commodity solution, it will also allow your agency to mitigate potential risks before entering into a contract.

There are a number of ways your organization can mitigate risk with your government solicitations:

- Plan After You Start Planning: Proper planning for a substantial agency procurement can help manage the project efficiently and effectively by scheduling the needed procurement activities in a manner that complies with the agency's policies, needs and resources. This will enhance transparency and minimize risk by enhancing predictability.

- Hindsight is 20/20, Should Not Refer to Your Scope of Work: An agency's scope of work and the expectations of a potential vendor must be clearly defined. If the user department is not certain of how to develop a scope of work, then start with publishing a Request for Information (RFI). An RFI can be used to gather information about industry standards and innovative processes.

- Oranges aren’t Apples: By standardizing evaluations and the scoring criteria, subjectivity will be removed from the process. Make sure you have the information you need and can make an apples-to-apples comparison in order to score potential vendor submissions.

- Show Me the Money: The financial strength of a potential vendor should be part of your evaluation process. Request financial reports as part of the proposal submission or require a performance bond. Create a financial stability rating scale. Ratings do not need to be complicated to be effective. There can be three classifications – satisfactory, moderate and unsatisfactory. Moreover, it provides more consistency in the scoring process and is simpler to understand.

- Would You Hire Them Again?: Checking references is a best practice when choosing a potential vendor. A few simple questions you can ask can help you judge the potential vendor objectively and in a balanced way. Is your organization of similar size? What are some things you wish the vendor did differently? Does the vendor work well with deadlines? Where deliverables met?

- Copies of the Contracts: Attach a sample copy of your agency’s contract to the solicitation. This will allow potential vendors to submit any exceptions to your agency’s standard terms and conditions.

By adhering to these practices, agencies can reduce contractor risk and awards will be less susceptible to scrutiny and protests.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Shannon Pleasant

Procurement and Risk Manager, City of Missouri City, TX

Summary of Qualifications

Oil and gas, construction and government procurement, contract administration, contract negotiation, enterprise resource planning, organizational budgeting, risk management.

Responsibilities

Shannon oversees the contracting and procurement functions for the City of Missouri City, TX. She represents the City's best interest in negotiating contracts and formulating policies with suppliers and resolves a variety of purchasing issues/problems for both internal and external customers. Her risk manager duties include overseeing the City’s comprehensive insurance and risk management program, assessing and identifying risks that could impede the reputation, safety, security, or financial success of the City. Shannon conducts risk assessments, collecting and analyzing documentation, statistics, reports, and market trends. She establishes policies and procedures to identify and address risks in the City’s contracts and departments. She also reviews and assesses risk management policies and protocols in addition to making recommendations and implementing modifications and improvements.

Business Experience

Shannon has 20+ years of experience in procurement, finance and contract administration. Her industry experience includes the oil and gas, construction, state, county and municipal government.

Professional Affiliations

Southeast Texas Association of Public Purchasing Professionals (SETAPP)

National Institute of Governmental Purchasing (NIGP)

National Forum for Black Public Administrators (NFBPA)

Public Risk Management Association (PRIMA)

Education

Bachelor’s Degree in Business Administration from Houston Baptist University

Currently pursuing a Master's in Public Administration from Northcentral University

Certified Texas Contract Developer (CTCD)

Before the pandemic, only 3.6% of the US workforce worked remotely. And according to a report by CNBC, the unexpected surge in work from home setups created a great demand for worker monitoring systems. Today, software like ActiveTrak, Hivedesk, and Time Doctor are the biggest players in this growing marketplace. However, with features like keystroke logging, browser monitoring, screen recording, and monitoring solutions, one can't help but ask: are worker tracking solutions too invasive?

What exactly is being monitored?

Resume help site StandOut CV recently released a comparison report on 32 employee monitoring websites. It revealed that 75% of worker tracking software include features that record employees’ screens; 65% can show employers their workers’ browsing history, with an undisclosed number of apps including incognito searches; 34% allow employers to access devices and make changes to computer settings; and 22% let employers access cameras to take photos of employees at work. Additionally, a whopping 44% of monitoring software can give employers a record of everything their employees have typed, including login information. Around 47% have stealth mode, a feature that allows the software to monitor users without them knowing.

There is an argument that this same method of monitoring employees has been in place in traditional workplaces for years. When you work in an office, you have supervisors overseeing your work, and you are expected to use company’s facilities for work purposes and nothing outside of that arrangement.

However, this argument ignores the fact that remote workers are operating in a space that belongs to them. Remote employees don’t have the option to report to a physical office, so when you place extensive surveillance on them in their own homes, monitoring activity on their personal devices — that’s a different story. They should be granted privacy, especially when they are in their own spaces.

A question of stakes

On the other hand, there are industries and lines of work that naturally benefit from employee trackers. The supply chain, for example, has rolled out industry-wide technology such as telematics. This technology is powered by GPS tracking systems, which Verizon Connect notes also monitors driver behavior. GPS technology can provide insights into how truck drivers behave on the road, based on the data about their speed, tardiness, and idling hours. While this information largely benefits fleets by improving efficiency, monitoring workers can also be very important for their own safety and security.

Although, it’s worth nothing that not all industries operate under such high stakes. Desk workers such as accountants, programmers, and writers aren’t like drivers – they don’t need to consider whether their driving habits are endangering other vehicles on the road. While missed deadlines can cost time and money, the inefficiency of their working processes don’t cause any immediate external harm. And NBC News reports that invasive surveillance software can lead to low morale, which ends up reducing productivity. This is mainly because using monitoring software can look like the employer doesn’t trust the workforce to manage their own time — you’re telling your workers you don’t believe they’ll do their jobs unless they are being supervised. Thus, employees feel stressed, detached, and even undervalued. The combined effects can push workers to seek kinder employment landscapes, increasing the company’s turnover rates.

Numbers don’t tell the whole story

The simple truth is that employers can never get a full picture of actual productivity with just keystrokes and logged hours. A content writer might log fewer keystrokes because he or she can draft ideas more quickly on paper. Meanwhile, a programmer might log multiple hours and keystrokes and not actually complete any working code. How long a person works, and how much input they produce, isn’t always an accurate measure of what they have accomplished.

For all their invasiveness, monitoring software might not even be the best way to push productivity. In 'The Biological Basis of Complacency', Sharon Lipinski stated that complacency isn’t a choice, but rather a neurological byproduct of doing repetitive work. When the brain gets used to a certain habit, it requires fewer and fewer neurons to perform the task. As a result, their external awareness may be decreased. The solution, then, isn’t to bog them down with more reminders to do work, but to find ways to keep their brains actively engaged.

Employers would get the most benefit out of tracking software if they were mainly used as supplementary evaluation tools. Even then, they need to be transparent with their employees and refrain from using invasive features such as stealth mode and keylogging. The best way to increase productivity is to show your employees that you value them, which can be achieved when fostering an environment that promotes trust.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Reanan Jannie

Freelance IT Consultant and Blogger

Summary of Qualifications

Reanan likes to keep herself busy, so she's a woman who wears many hats. Since she loves the challenge of problem-solving, she has worked as an IT consultant for many years now. She believes that her strongest suit in the field of IT is her skill in cybersecurity. Due to the rising demand for cybersecurity professionals, Reanan also decided to share her IT knowledge through writing. She primarily writes about cybersecurity, but she also loves the challenge of writing about different topics.

Education

BA, Computer Science