Whether citizens who attend public meetings are representative of citizens not in attendance regarding their attitudes, communication, behaviors, past experiences elected and appointed officials, faith in the local government rule and lawmaking processes, and demographic characteristics, is open to debate. What is not debatable, however, is the increase in inappropriate behavior during public board meetings ranging from disruptions to violence or threats of violence. Enter the risk manager. Unlike more traditional risks which can often be avoided or transferred, the risks associated with public meetings must be managed and mitigated.

It has been my experience that public boards generally conduct themselves honestly and professionally. However, some boards are their own worst enemy when it comes to dealing with those outspoken, rude, or hostile citizens who differ with a board’s perceptions or actions. The risk manager should ensure that the public boards or committees in their organization publish rules regarding the manner in which public meetings are conducted. Further, when it comes to the citizen comment portion of the meeting, it is essential that the board or committee in question educate the public as to the mechanics of these rules, as well as provide training as to how to effectively present their concerns to the board. For instance, a board can hold a workshop for citizens and other stakeholders who wish to address the board, and suggest that the person(s) desirous to speak:

- Learn when and where the board is meeting

- Request a copy of the agenda in advance of the meeting (most states have public records laws designed for such a purpose)

- Request a copy of the board’s public comment policy which will provide citizens with the length of time allotted, as well as whether the board will engage citizens, rather than merely letting them speak

- Discuss a specific topic in the time allotted

- Be clear about what they want the board to do, e.g., change a particular policy, introduce a new program or better support an existing one

- Follow up with a letter or testimony to the entire board, even if the stakeholder has previously spoken to an individual board member, to reiterate one’s points

- Remind stakeholders that not all board meetings are open to the general public. Most states permit certain boards to meet in closed session to discuss threatened or ongoing litigation

Along with assisting the public in effectively appearing before the board, the board must enforce its public comments policy consistently and uniformly, and have the wherewithal to eject from the meeting, persons who disrupt the governmental process, make threats of violence, etc.

In summary, the risk manager should strive to inculcate in board and committees that the work they put in before meeting is crucial to running successful meetings where public business should be conducted in a civil and professional manner, while permitting the general public to have a voice. Public boards and committees must have easily understood and legally defensible policies in place, and board members and administrators must understand their roles in meetings. When citizens wishing to address a board know the rules of the game, and know that they will be treated fairly and equitably, a board can go a long way in minimizing meeting mayhem, while enhancing its relationships with the citizenry it was designed to serve.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Dr. Joe Jarret, MPA, J.D., Ph.D.

Lecturer, Department of Political Science, University of Tennessee

Joe is a former public sector risk manager, attorney and mediator who has served four different local government entities as chief legal counsel and who lectures full-time on behalf of the University of Tennessee’s Public Management And Administration Program. He is a former United States Army Combat Arms officer with service overseas, a former federal law enforcement officer who holds a Bachelor of Science degree in criminal justice, a Master in Public Administration degree, a Juris Doctorate, and the Ph.D. in educational leadership. He is the past-president of the Southwest Florida chapter of PRIMA and has been twice named PRIMA’s “Author of the Year.”

First responders serve as the frontline managers of risk and safety in the public sector, responding in real time to worst-case scenarios across our communities 24 hours per day, every day of the year. The threats responded to by our police, firefighters, EMS professionals and 911 dispatchers include murders, suicides, high-risk domestic violence, environmental catastrophes, active shooters, mass evacuations and myriad other terrible realities most of us never confront firsthand.

Responding to these harsh realities leads to two interrelated types of risk. The first, Decision-Action Risk, captures the extent to which first responder decisions and actions mitigate the risk of the situations they respond to over time. The second, Wellness-Trauma Risk, captures the extent to which first responders are negatively affected over time by the stressful and traumatic aspects of the situations and scenarios to which they respond. Of course, Wellness-Trauma Risk, by undermining emotional stability and decision-making quality, directly aggravates Decision-Action Risk, which in turn fuels great Wellness-Trauma Risk. Both types of risk are the direct concern of risk managers, first responders, the public at large and any stakeholders concerned with mitigating risk or maintaining public safety. Research demonstrates that first responders are also suffering from an unsustainable degree of understaffing, further aggravating these risks. Fortunately, many solutions are available.

People Risk Management Solutions

First responders benefit substantially from high-quality peer support, or fellow first responders specially trained to provide support related to both work and non-work stressors. Because peer supporters are also first responders themselves, they are easy to access, capable of building trust, and relate effectively to the realities of the work. Research has shown that 90% of first responders who used peer support found it helpful, 80% reported they would seek assistance again and 90% said they would recommend the program to a peer (Digliani, 2018).

While peer support is a key part of the solution to managing Wellness-Trauma Risk, and in turn Decision-Action Risk, it is far from the entire solution.

Many challenges experienced by first responders routinely go beyond what can be resolved with peer support alone and must instead be referred to licensed clinicians qualified to treat post-traumatic stress, depression, suicidal thinking, and related mental health issues common amongst first responders. Many years of firsthand experience has taught us the critical importance of utilizing clinicians who are culturally competent (i.e., familiar with the realities of first responder work), effective (i.e., skilled at treatment), professional (i.e., ethical and law-abiding) and available (i.e., responsive when needed).

Technology Risk Management Solutions

First responder Wellness-Trauma Risk and Decision-Action Risk are challenges we face on a national scale, and therefore nationally scaled solutions are necessary to ensure consistent quality, accessibility and availability of support. Technology has become a vital key to addressing these challenges on a national scale. Examples of agencies implementing high-tech wellness solutions for their first responders include the Vacaville Police Department and the Memphis Police Department, and both agencies subsequently won the prestigious Destination Zero National Officer Safety and Wellness Awards, a testament to their innovation and leadership in implementing strong wellness programs designed to care for their personnel at scale.

Other examples of technology being utilized to address the Wellness-Trauma Risk and Decision-Action Risk include providing training and certification of peer supporters, training and certification of first responder clinicians, access to certified first responder peer supporters and clinicians, access to crisis support resources, a wide range of high-quality wellness self-help tools designed specifically for first responders, and in-hand, on-demand access to the full range of wellness tools and support resources available to first responders at any given public safety agency, regardless of the size of the agency.

Leadership Risk Management Solutions

Public safety agencies have experienced substantial leadership turnover in recent years. Fortunately, strong leadership training is available for first responders at mass scale. For example, retired Navy Seals and NYT best-selling authors Jocko Willink and Leif Babin recently co-created online training for first responders on topics including extreme ownership, leading up and down the chain of command and how to care for team members while also achieving the overall mission of your organization. Additionally, executive peer support for police chiefs and fire chiefs is now available to help ensure that leaders have access to the same level of support available to other first responders.

Conclusion: Large-Scale Challenges and Scalable Solutions

First responders nationwide face enormous challenges and stressors on a routine basis leading to Wellness-Trauma Risk and Decision-Action Risk, which should be a topline concern for anyone invested in upholding public safety. Fortunately, many scalable solutions now exist that can help address these challenges via training and certification programs, scalable technology applications, leadership development and peer support.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Dr. David Black, Ph.D.

President, Lexipol Wellness Solutions & Chief Psychologist, California Police Chiefs Assoc.

Summary of Qualification

Dr. Black has 20+ years serving first responders as a psychologist. He is

president of Lexipol Wellness Solutions, serving 2,000,000 professionals and more than 10,000 agencies nationally.

Dr. Black is the founder of Cordico and has served on working groups and committees for the International Association of Chiefs of Police, the National Police Foundation, the National Sheriffs Association, the National Fraternal Order of Police, and other associations to advance first responder wellness nationwide.

Responsibilities

Dr. Black's responsibilities include collaborating on wellness solution strategy and execution for public safety agencies across the United States, in addition to strategic partnerships, content development, recruitment, acquisitions, thought leadership, and speaking at conferences.

Business Experience

- Founder and CEO of Cordico Inc. (sold to Lexipol in 2020)

- Founder, CEO, and Chief Psychologist of Cordico Psychological Corporation (sold privately in 2022)

- President of Lexipol Wellness Solutions (Current)

- Lexipol Board of Directors (Current)

- 20 years of successful entrepreneurial business experience

Professional Affiliations

- Founding Member - National Sheriffs’ Association (NSA) Psychological Services Committee (2018 to Present)

- Advisory Board Member - National Police Foundation, Center for Mass Violence Response Studies (2019 to Present)

- Ethics Committee Member - International Association of Chiefs of Police (IACP), Police Psychological Services (2019 to 2023)

- National FOP Officer Wellness Committee and Provider Evaluation Subcommittee (2019 to Present)

- Member - International Association of Chiefs of Police (IACP), Police Psychological Services (2013 to Present)

- Committee Member - Psychological Fitness-for-Duty Evaluation Guidelines Revision Committee (2017-2018) International Association of Chiefs of Police (IACP) Police Psychological Services Section

- Committee Member - Officer-Involved Shootings Guidelines Revision Committee (2017-2018) International Association of Chiefs of Police (IACP) Police Psychological Services Section

- Member - Police and Public Safety Psychology Section, American Psychological Association

- Member - American Psychological Association (APA)

(2001 to Present)

Education

- Ph.D., Clinical Psychology (APA-Approved) - University of Georgia (2000)

- Pre-Doctoral Internship (APA-Approved) - Seattle Veterans Affairs Medical Center (1998-1999)

- Master of Science, Clinical Psychology - University of Georgia (1997)

- Bachelor of Science, Psychology, cum laude - University of Washington (1995)

- Bachelor of Arts, Philosophy, cum laude - University of Washington (1995)

Community special events are an opportunity for the community to gather to participate in an activity that may be public or private, lasting in duration from a few hours to days in duration. They have the capacity to generate community publicity and dollars for the local economy while instilling goodwill in community endeavors. If managed efficiently, the collaborative efforts between government agencies and private sector companies combine resources to promote the special event in a community context, increasing the profile of government, private enterprise and hometown initiatives.

Special events are a unique opportunity to show the very best of what a community has to offer. Communication and planning are key to inviting a community’s diversity into the organizational process of determining the scope and breadth of an event. Local businesses often lack resources to promote their products and services. Special events, while labor intensive, offer the best of a broad-brush effort to allow participation of all size and types of businesses to benefit from the generic publicity a special event may have to offer.

Public private partnerships are important in organizing special events on a large scale regardless of whether they are in a private or public setting. An argument can be made that both are mutually beneficial to each other…if done correctly.

Success in any endeavor requires constructive communication in managing the totality of the risk associated with it. Constructive communication includes proactively communicating the initial special event program proposal and then engaging in ongoing communication to provide updates as they occur. Population projections and the scale of the event will drive the resources needed to effectively manage the risks associated with the event and plan risk mitigation activities for the inevitable issues that may arise. Planned activities, vendors and entertainment need to be examined individually and in the context of what is being planned.

Public resources for community event planning begin with a robust licensing/permitting process. That review should include a multidisciplinary approach by risk, public safety/fire and police, code enforcement, public works and building/zoning. Each of these reviews brings with it an opportunity to ensure the success of an event and to proactively identify potential issues that may negatively impact it. They also come with a cost that should be proactively assessed and managed including additional staffing, overtime and public works preparation.

Private resources for special events may include increased staffing, security, event participation fees, and planning for potential business obstructions or modifications if the event has special conditions. Building-Zoning and Code Enforcement play a special role in assisting in the determination of whether the event lawfully meets a community’s land use regulations.

Strategic risk planning seizes opportunities. Community special events are opportunities for entrepreneurship, publicity, participation, and an influx of money into private and public coffers. They attract existing customers and visitors, expanding customer business bases and potentially attracting new enterprises. They also increase community risk profiles. These events attract people of various demographics and personal experiences. Social media, while beneficial, has the potential of generating negative risk characteristics that require more careful considerations to ensure a community’s spirit is protected while ensuring the civil liberties of all.

The nuts and bolts of risk mitigation for special events relies on proactive and effective communication and partnerships. It’s important to understand that the private business sector is an integral partner in the success of any special event and municipal risk mitigation. Remembering that the private sector is freer to embrace innovation enables risk to learn and grow and be mutually beneficial to governance in special event planning and its community.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Marilyn Rivers, CPCU, ARM, AIC

Principal, Rivers Risk Consulting, LLC

Summary of Qualification

Marilyn Rivers is a nationally recognized public-private entity strategic risk management professional and educator who has extensive experience in delivering program development, fiscal oversight, compliance, and education tailored to meet the dynamic needs of business. She recently retired from public service with a combined thirty-five years of experience managing risk in both the public-private sectors. Marilyn is the Principal of Rivers Risk Consulting. She holds a BS in Chemistry from Clarkson and a MEd from Tufts University. Her professional designations include the CPCU, ARM and AIC. Marilyn was the recipient of the PRIMA Risk Manager of the Year in 2007. She was instrumental in designing the resurgence of PRIMA Institute and actively facilitated and designed its programming for many years. She actively provides risk mitigation services to the local non-profit community. She’s an active volunteer for multiple organizations and currently serves as the President of her Lions Club. She’s won national and international awards including the Lions International Robert J Uplinger Award (2014), Knight of the Blind (2016), and Melvin Jones Fellowship Distinguished Service Award (2018).

Professional Affiliations

- PRIMA

- CPCU Society

- Adirondack Regional Chamber of Commerce

- Lions International

Education

- NIMS Certifications, US Department of Homeland Security

- Associate in Claims, The Institutes

- Associate in Risk Management, The Institutes

- Physics Minor, SUNY Albany

- Chartered Property Casualty Underwriter, CPCU Society

- Masters in Education, Tufts University

- Bachelor of Science in Chemistry, Clarkson University

Many employers make the mistake of automatically terminating an employee who is unable to return to work after their leave under the Family Medical Leave Act (FMLA) has been exhausted. This can be a mistake because the employer is neglecting to consider whether the Americans with Disabilities Act (ADA) applies. The same is true for employers who adopt policies limiting light duty to on-the-job injuries and do not provide exceptions for persons with disabilities. While not every serious health condition rises to the level of a disability, there is no reason why an employer should not go through the ADA interactive process with an employee with a serious medical condition since it is not an ADA violation to refuse an accommodation for someone who is not actually disabled, even if you regard the person as disabled (29 CFR Part 1630.9).

In the more common situation where an employee is on FMLA and is unlikely to be able to return to work or will have work restrictions, with two to three weeks remaining of FMLA, the employer should send the employee a letter or email reminding them of the expiration of their FMLA leave, the date they must return to work, and the requirement that they supply a fitness for duty form from the treating physician. In the letter, advise that if they need more time off or will need any accommodations, they need to reach out as soon as possible to get ADA forms. The employer should then send a form for the employee to complete within 15 days, asking the following questions:

- Identify any disability that is interfering with your ability to perform your job.

- What essential functions of your job are you unable to perform due to your disability?

- What non-essential functions of your job are you unable to perform due to your disability?

- Identify all accommodations that you believe would allow you to perform the functions identified above and how long you anticipate needing the accommodation.

- If you are not sure what accommodation is needed, do you have any suggestions about what options we can explore?

- Is your accommodation request time sensitive? If yes, please explain.

- If you are requesting a specific accommodation, how will that accommodation assist you? How long do you expect to need this accommodation?

- Please provide any additional information that might be useful in processing your accommodation request.

Along with this form, include a form for the treating physician to complete. A good one is available from the Job Accommodation Network: https://askjan.org/topics/Sample-and-Partner-Examples.cfm. Finally, in the letter, schedule an ADA interactive process meeting for day 16 after sending the forms.

During the meeting, go over the completed forms and determine what the employee is asking for and whether the requested accommodation is reasonable. If not, are there other possible accommodations that will work? If the employee needs more time off, consider granting the request for up to four more weeks, even if the time will be unpaid. If the employee needs assistance at work, consider trying an accommodation for four weeks and then reassess the effectiveness of the accommodation or whether it created an undue burden. Employers should make an individualized assessment for each request. Document all accommodation requests and responses. The key to success is keeping the lines of communication open with the employee and continuing to explore possible options.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Julie Bruch

Partner, IFMK Law, Ltd.

Summary of Qualifications

Julie has 30 years' experience handling employment law matters in state and federal courts as well as administrative tribunals. She provides counseling management and provides training to employers on employment laws.

Responsibilities

Julie is responsible for litigating cases through jury or bench trials and all pretrial work. She handles matters before the EEOC and Illinois Department of Human Rights. Julie also provides counseling for clients on employment laws and presents training classes for employees and management on various employment laws and how to manage employees.

Professional Affiliations

Defense Research Institute, Illinois Association of Defense Trial Counsel (author the Employment Law Column for the IDC Quarterly Magazine), American Bar Association, Chicago Bar Association

Education

- Northwestern University, BA

- Loyola University of Chicago, JD (Student Articles Editor of the Loyola Law Journal)

Whatever doesn’t kill you makes you stronger? WRONG! Whatever doesn’t kill you COULD make you stronger IF you learned the right lessons. Going through tough times can have a silver lining: It can teach people to become more resilient. That doesn’t happen naturally, but the supportive relationships that folks learn to lean on, the broader perspective, the hope that people develop, all these can develop and strengthen resilience, and those skills come in handy after the bad times end. Bad things can provide an opportunity to “grow.” We review 10 steps to wrenching resilience from adversity.

WHAT IS RESILIENCE?

Resilience is the process (and outcome) of successfully adapting to difficult or challenging life experiences, of “bouncing back.” How do we develop resilience? Through mental, emotional and behavioral flexibility and adjustment to external and internal demands.

Resilience gives people the strength to tackle problems head-on, overcome adversity and move on with their lives. Following large-scale traumas such as terrorist attacks, natural disasters and the COVID-19 pandemic, those people who demonstrated the behaviors that typify resilience experienced fewer symptoms of depression. Even in the face of events that seem utterly unimaginable, resilience allows people to marshal the strength to not just survive but to prosper (see Viktor Frankl, Man’s Search for Meaning). Many other “normal” life events challenge us and provide the opportunity to develop resilience, such as death, divorce, financial issues, loss and illness.

RESILIENCE IS LEARNED

Research shows that the resources and skills associated with resilience can be cultivated and practiced. However, just because you learn resilience doesn’t mean you won’t feel stressed or anxious. Resilience is a journey, and each person will take his or her own time along the way. You may benefit from some of the resilience tips below, while friends may benefit from others. The skills of resilience you learn during really bad times will be useful even after the bad times end, and they are good skills to have every day. Resilience can help you be one of the people who’ve “got bounce.”

RESILIENCE TIPS 1-3 (THE ACCEPTANCE TRIAD)

- Accept that change is part of life: Accepting what cannot be changed can help you focus on what CAN be changed.

- Cut yourself some slack: When something bad happens, stress levels go up. Go a little easy on yourself -- and on others.

- It’s not just stress -- Let yourself have feelings and grieve losses: Depending on the situation, you may experience anger, sadness and/or fear. This does not mean you should act out your emotions, but rather be aware of them. Be aware of the body sensations that accompany strong emotions and let them pass through you.

RESILIENCE TIPS 4-6 (GET SUPPORT, AND START MOVING ON)

- Make connections: Family, friends and colleagues all are important. Accepting support from those who care about you and will listen to you strengthens resilience. Look into groups in your community or on the internet that can help foster your interests or teach you relevant coping skills.

- Express yourself: If it’s too hard to talk to someone about your feelings, do something else to capture your emotions, like start a journal or create art. Look for opportunities for self-discovery.

- Take decisive action: Focus on what you can control. Act on adverse situations as much as you can, don't just wish. Set realistic goals and do something toward achieving them daily.

RESILIENCE TIPS 7-10 (WORK ON YOUR HEAD)

- Be mindful of the good things in your life: Resilient people count their blessings. Let the people in your life know what they mean to you. Take a few minutes every day to reflect on one aspect of your life that you’re thankful for.

- Identify your resources and strengths: Too often we focus on our weaknesses. Reverse that. Focus on using your strengths and resources to identify solutions. Reflect on how you have successfully dealt with other challenges in the past.

- Maintain a hopeful outlook: No one can reverse what happened, but you can change how you interpret and respond to events. Develop a vision that inspires you to move forward. Be the model you want to set for others.

- Keep things in perspective: Everything comes to an end. Think back on a time when you faced up to a challenge. Think about the important things that have stayed the same as the world was changing. Use relaxation techniques to center yourself. Visualize what you want rather than worry about what you fear.

TAKE AWAYS: 3 RESILIENCE PRACTICE EXERCISES

- Change the narrative

- Stop ruminating

- Expressive writing can help

- Face your fears

- Expose yourself to what scares you

- Consider the worst case scenario

- Cultivate forgiveness

- Let go of anger

- Forgive yourself

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Dr. Michael Lacroix

Medical Director, The Hartford

Summary of Qualifications

Dr. Lacroix is medical director with The Hartford. He is a licensed psychologist in Florida. He has worked in the overlapping areas of disability and workers’ compensation for the last 30 years, in a variety of clinical, management, program development and consulting roles. Prior to joining the corporate world, (Concentra, then Coventry, then Aetna, and now The Hartford) Dr. Lacroix held academic appointments and developed a large clinical practice focused on assessment, treatment and rehabilitation of injured and disabled workers. He also carried out grant-supported research over many years, resulting in over 100 peer-reviewed publications and papers. He is a frequent contributor at industry conferences and publications.

Responsibilities

- Clinical review of complex psychological cases

- Staff education

- Program development

- Research

- Thought leadership (publications, conference presentations board memberships)

- General advisory functions related to behavioral health

Business Experience

- 2018 - present: Medical Director, The Hartford

- 2013 - 2017: Associate Medical Director, Aetna Disability

- 2002 - 2017: Director, Behavioral Health Services, Coventry Workers’ Comp Services

- 2000 – 2001: Regional Training Manager, East Region, Concentra Managed Care, Inc.

- 1998 - 2000: Regional Manager / Canada, Concentra Managed Care, Inc.

- 1981 - 1998: CEO and Chief Psychologist, Lacroix, Scher Consultants. Grew private practice into multi-million dollar psychological – vocational practice and ancillary businesses

- 1988 – 1998 Chief Psychologist, and Senior Psychological Consultant, West Park Hospital

- 1978 - 1989 Clinical and Research Consultant to Psychology Department, Ontario W.C.B.’s Downsview Rehabilitation Centre

- 1974 - 1991 Lecturer, promoted to Assistant Professor, then to tenured Associate Professor of Psychology, York University, Toronto, Ontario

Professional Affiliations

- American Psychological Association

- International Critical Incident Stress Foundation

- Licensed Psychologist: FL license PY6750

Ian Petrelli’s 2023 Annual Conference Student Scholar Reflection

Ian Petrelli

Risk Management/Insurance and Actuarial Science Major, Florida State University

Having received a 2023 PRIMA student scholarship provided great learning opportunities, including networking with professionals and firms while gaining a greater understanding of both private and public risk. As an aspiring actuary, the experiences that I took away from PRIMA 2023 will be invaluable as I continue my education.

One of my favorite aspects of attending the PRIMA conference was getting to network with industry professionals of many backgrounds. PRIMA also helped to facilitate the growth of student scholars by assigning a few mentors to the group. Each mentor brought a certain field of expertise and helped me in all aspects of insurance. An additional networking opportunity from PRIMA was through the conference hall I was able to network with many firms and brokerages to learn how actuaries fit into their business. Part of my duty as a PRIMA scholar was a meet and greet at the PRIMA booth in the conference hall. This was an additional way for me to network as well as continue to get to know the PRIMA leadership. All in all, the forging of new connections through the conference made me feel at home in the insurance community as well as opening doors for the future.

Another amazing learning experience for me during PRIMA 2023 centered around the variety of educational sessions offered. The two sessions that I attended that stuck with me the most were An Approach to a Captive in the Public Sector and Property and Casualty Pricing for 2024. These two most likely stuck out the most to me because they have to deal more with issues within the industry. Since my father is also an insurance professional and looking into forming a captive, I understood the overall idea of one, but through the session I gained a better idea on how a municipality would conduct a feasibility study in an effort to form a captive. Through the session on property and casualty pricing, I saw the current state regarding the rising cost of premiums. The speaker went into great depth on why P&C premiums are becoming so outrageous. In addition, the speaker had an associate that was an actuary that assisted in his presentation, allowing me to see his presentation from the perspective of an actuary. Ultimately, I learned a lot about the public side of insurance from the provided sessions.

Overall, being able to attend the 2023 PRIMA conference as a student scholar was an exceptional opportunity to better myself for a future in the insurance industry. Since I am only a rising sophomore in college and just beginning my journey, the experiences that I took away from PRIMA 2023 will be immeasurable.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Ian Petrelli

Risk Management/Insurance and Actuarial Science Major, Florida State University

Ian is currently in his freshman year at Florida State University, but is academically a junior double-majoring in risk management & insurance and and actuarial science. His interest in the insurance sector was sparked by a combination of the finance magnet program that he participated in during high school and his father, who is the current director of risk management for Orange County, FL. From there, Ian has built the foundation to the career path he wants to pursue and the professional mannerisms needed for the business world. Ian has worked in several internships, including Addition Financial as a student teller, Aeras Technologies as an accounting assistant, and Brown & Brown Insurance. These experiences have given him a well-rounded grasp on finance and insurance.

Governance involves grace.

The foundations of managing risk in any sector begin with partnerships. Partnerships in risk management are founded on respect, professionalism and perseverance. Perseverance is important in achieving consensus and consensus is needed to move any idea, program and opportunity for improvement forward…right?

So why is it so hard to move our risk management ideas and programs forward of late?

Risk management has lately suffered from generational mistrust and an onslaught of electronic communication. It’s easier to send an email, text, or snippet, than picking up the phone or getting up from behind our desk to do that old fashioned “in person” thing – physical communication. I’m dating myself, right?

The thumbs up and thumbs down buttons on social media have become a shorthand way to critique an idea, a thought or a commitment. The gestures have taken away a good old argument for justification – the passion of the pros and cons and the ability to see the value of both.

Grace in managing risk is about the finesse of the approach. It involves courtesy and a professional elegance displayed as we listen to differences of opinion on a subject matter, acknowledge the importance of that information, and ensure the individual we are speaking with understands that we believe that they matter to the overall solution of the issue.

Governance these days often mirrors a reality entertainment show with unkind words, personal attacks and undying vendettas. It often loops into endless venues in person, online and throughout social media. As risk professionals, we cringe at the negativity contained within the words, the actions and the consequences. Try as we might to mitigate the barrage of negativity, it seeps into the very fabric of the risk we are trying to manage or mitigate.

It is so very easy to hit the “send” button on our electronic devices. It is a nonpersonal way to avoid the unpleasant, refrain from the negative encounter or suffer the wrath of an individual not understanding the “we” instead of the “me” as we collectively manage the totality of risk for our organizations. The problem is that the seemingly negative interactions we observe are our growth potential and our opportunity to achieve the consensus on governance we strive for in our profession.

Human interaction in managing risk is our opportunity to seize the day – to learn the nuances of the issues at hand and to understand that there are no clear delineations to any one result. Risk management is wonderfully messy. It is so multidimensional that an AI program will never do it justice as long as there is a living human being as part of the equation of life.

Governance is messy. Leadership succeeds when we collectively acknowledge that risk is made up of a myriad of human actions that are best served by human contact. Grace in governance is that hands on approach to meeting and greeting and listening and sometimes agreeing to disagree. Let’s dust off our walking shoes and take a stroll. Your journey towards positive governance lies in your acceptance that sometimes, it’s not as easy as a keystroke.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Marilyn Rivers, CPCU, ARM, AIC

Principal, Rivers Risk Consulting, LLC

Summary of Qualification

Marilyn Rivers is a nationally recognized public-private entity strategic risk management professional and educator who has extensive experience in delivering program development, fiscal oversight, compliance, and education tailored to meet the dynamic needs of business. She recently retired from public service with a combined thirty-five years of experience managing risk in both the public-private sectors. Marilyn is the Principal of Rivers Risk Consulting. She holds a BS in Chemistry from Clarkson and a MEd from Tufts University. Her professional designations include the CPCU, ARM and AIC. Marilyn was the recipient of the PRIMA Risk Manager of the Year in 2007. She was instrumental in designing the resurgence of PRIMA Institute and actively facilitated and designed its programming for many years. She actively provides risk mitigation services to the local non-profit community. She’s an active volunteer for multiple organizations and currently serves as the President of her Lions Club. She’s won national and international awards including the Lions International Robert J Uplinger Award (2014), Knight of the Blind (2016), and Melvin Jones Fellowship Distinguished Service Award (2018).

Professional Affiliations

- PRIMA

- CPCU Society

- Adirondack Regional Chamber of Commerce

- Lions International

Education

- NIMS Certifications, US Department of Homeland Security

- Associate in Claims, The Institutes

- Associate in Risk Management, The Institutes

- Physics Minor, SUNY Albany

- Chartered Property Casualty Underwriter, CPCU Society

- Masters in Education, Tufts University

- Bachelor of Science in Chemistry, Clarkson University

There have been many claims filed that do not, at first glance, appear to have a large exposure. In the public sector, sometimes the insured’s reputation has been magnified by the media after a detrimental has taken place. When a case is reported that does not appear to have a large exposure, the plaintiff attorney can do research on a town, a school district or a college to see if there is any negative reputation that can be used.

CLICK HERE for Part 1

Communication with Elected Officials

If the media contacts you and, if you do not have information ready to share, do not be surprised if they reach out to your mayor, city council members or other elected officials. Elected officials are not hesitant to talk to the media and, if they have not been advised of anything by the claim handlers about a recent incident, they may offer an opinion that can be a problem. In several large cities, the mayor has generated very negative publicity regarding police related cases that have garnered immediate media attention. It is important to keep your local government updated regarding a case.

There can be a longer list of things that should be evaluated, but this article is designed to help you understand the importance of making sure your claim staff is properly trained to determine what things can create a larger exposure, even if it feels insignificant at first.

Internal Communication

It is important to be willing to share things that happen within your group. Several times, I was involved with a case that was an accident that occurred in a different department or group.

When something occurs that does not originally appear to be significant, some departments will not consider reporting it to the risk management department because they feel they did nothing wrong. It could be weeks later that a plaintiff attorney gets involved. An investigation that starts several weeks later can have a restriction on whom to contact regarding the incident, in turn leaving some witnesses off limits. It is important that your risk management group is kept advised of things that have occurred.

More Communication

If you do have an excess insurance policy, you should develop a good level of communication with their claim staff because they may have dealt with similar cases in many different states and can help you determine those extra areas that should be analyzed.

When a claim is reported, the file handler should begin an investigation quickly and not be hesitant in reaching out to the involved people within 24 hours. There are many times that the media learns of an incident soon after it occurs. Uninvolved people may have witnessed some of the incident and many will use their phones to video and record what they have observed. Even though they may not have witnessed all of the incident, they will share their videos and their opinions with the local news media or decide to post things on social media within minutes, which can stimulate negative publicity that may have an effect on the case. These eyewitnesses may not have seen the whole event, and their opinions are not always 100% positive and correct. Your file handlers need to quickly learn all details about what happened and have good conversation with the employees involved with the incident. It is always good to have your file handlers build a good relationship with your employees before any incidents occur, so the involved parties will not be hesitant to share anything with them when something happens. Another important thing to review is whether or not the incident will be covered under your insurance policy. If you are not totally self-insured, you need to make sure your coverage will apply and will help you know when it is a good time to report this incident to your carrier.

It is just very important to investigate all parts of an accident that could generate the plaintiff attorney’s decision on how to pursue the claim.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Richard Spiers, CPCU, ARM, ARe, AIC

Consultant, Spiers Consulting, LLC

Richard has been in the insurance industry since 1980 and was a claim executive in the reinsurance and excess marketplace since 1985. He was with Genesis Management and Insurance Services for over 20 twenty years. He is currently doing claim consulting work. Richard has extensive experience handling the wide array of claims faced by public entities, K-12 school districts and the higher education sector. Based in Chicago, he has also worked for Transamerica Insurance Group, Northbrook Excess and Surplus Insurance, CNA and Allstate Reinsurance. He is a graduate of Northern Illinois University, a member of the Society of CPCU, and holds associate designations in risk management, claims, and reinsurance. Richard has been developing and presenting insurance industry-related training sessions to a variety of client and industry groups for over 25 years.

There is a confluence of factors that make mentoring in today’s workplace even more valuable. The Great Resignation has led to a wave of retirees leaving the workforce, and with them their wisdom, knowledge and decades of experience gained on the job. As the next generation is learning new skills and industries, having a positive relationship with a mentor increases employee engagement, accelerates career development, promotes a diverse and inclusive workplace, helps retain high performers and can help with even attracting talent to your organization.[1]

Mentors are considered experienced, trusted advisors who share their knowledge, skills and wisdom to help another develop and grow. The goals of mentorship are to help mentees with career growth, introduce new business contacts and act as a resource.

Finding a mentor can seem daunting, but it doesn’t have to be. Mentors literally come in all shapes or sizes! You could ask someone who has your dream job or follow an influencer, leverage a formal workplace program, or draw from your own professional circle or industry resources. What’s key is to find someone that is willing to give you a hand up (not hand out!) and invest time to help in your career development and personal growth.

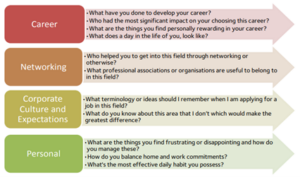

Once you have found a mentor, be prepared at your first meeting. The mentee drives the conversation around the length of the mentorship, frequency of meetings and sets tasks to be completed prior to each meeting. While that may seem daunting, here is an example of key topics and questions for your first meeting:[2]

As the relationship develops, tasks can be set and completed with both the mentor and mentee discussing progress, obstacles and guidance for future actions. Keep in mind, mentors don’t always tell you want you want to hear, but what you need to hear in order to grow. Feedback is an important element in mentorship, one that takes time to develop expectations and build trust.

There are numerous benefits to being a mentee that include:

- Learn the workplace culture

- Enhance skill development

- Networking opportunities

- Potential for promotion

- Problem-solving

- Knowledge Transfer, to name a few.

There are benefits to being a mentor:

- Validate the mentor’s leadership skills

- Become recognized as an advisor

- Learn to clearly communicate

- Gaining new perspectives

- Giving Feedback and finding new talent, and many more.

Good mentorship programs have the ability to accelerate staff diversity and inclusion too. These programs allow us to see others as people first, moving beyond labels and stereotypes. Mentors and mentees can help each other to redefine normal and create positive experiences within our workplace and communities. It's no wonder that 84% of Fortune 500 companies[3] offer some type of mentorship program. These organizations focus on finding the right match, making expectations clear, offering sufficient training and support, being specific and even making the mentorship program mandatory.[4]

Mentorship can go a long way to improving organizational performance as well as ensuring a pathway for the firm’s continued success. Mentoring is a way of connecting and sharing challenges while obtaining other perspectives from an unbiased resource. It is a great way to develop employees, deepen technical understanding, build connections and strengthen an organization’s talent pipelines.

[1] https://www.togetherplatform.com/blog/what-is-the-purpose-of-mentoring

[2] https://www.griffith.edu.au/__data/assets/pdf_file/0023/552263/MENTEE-FIRST-MEETING-CHECKLIST.pdf

[3] https://www.mentorcliq.com/blog/mentoring-stats

[4] https://www.forbes.com/sites/iese/2022/09/26/the-five-secrets-of-the-best-mentoring-programs/?sh=7a63519b3869

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Karen Caterino, MBA, ARM-P

Senior Vice President, Alliant Insurance Services, Inc.

Summary of Qualifications

Karen joined Alliant Insurance Services in 2021 and has been in the industry for over 23 years in various positions involving healthcare, risk management and insurance. Prior to joining Alliant, Karen worked at a global insurance brokerage as the Center of Excellence Leader for the western region public sector and higher education practice. Karen also spent 8 years in public service, serving as a city senior benefits/risk analyst and as a state risk manager. She is an active member and presenter with PRIMA and STRIMA and hosts a regular podcast series “Igniting Next Gen” for careers in risk and insurance.

Responsibilities

In her role, Karen works with Alliant colleagues and clients, utilizing her knowledge and understanding of their unique risk and insurance needs to optimize risk management and brokering solutions. Her focus is on leading public entity, education and pooling business growth and development initiatives. Her specialty is casualty line placements. Her background in risk management and insurance, consultative sales leadership, innovative program development and client team management is helping Alliant develop deeper client relationships while delivering excellence to the client experience.

Business Experience

23 years working in risk management and insurance.

ERM Experience

Helping public entity clients implement ERM, advising on integrating business strategies designed to mitigate or optimize organizational enterprise risk.

Professional Affiliations

PRIMA, STRIMA, NV RIMS, AZ PRIMA, OR PRIMA

Education

Karen graduated with her bachelor’s degree from Roanoke College, Salem VA and from University of Phoenix with her MBA. She has an Associate in Risk Management-Public Entities (ARM-P), is a Certified Public Manager®(CPM) and Certified Government Benefits Administrator (CGBA) and is currently a CPCU® candidate.

Workers’ compensation is probably not the first choice of someone searching for a cool career. Although work comp includes technology and Big Data, risk management, actuarial science, sales and marketing, healthcare, legal, executive leadership and has a myriad of services to support an injured employee and their employer, most equate work comp with a “claims adjuster.” What comes to mind is someone navigating complicated regulations in a relatively thankless job who has become an eternal cynic. A claims adjuster’s correspondence often involves negative subjects like an accident that hurt somebody, physicians who feel underpaid, and lawyers “on the other side.” The person they’re trying to serve, the injured employee (stop using the word “claimant” except on state-mandated forms), can be overwhelmed, anxious, uncooperative and/or countless other descriptions. When looking at the rosters of insurance carriers and TPAs around the country, the empty seats show the results of the stigma that has been earned over time.

However, there is a movement to reimagine the claims adjuster. Some of that is because the newer generations want purpose and meaning in a job that matches their values. Changing their title from claims adjuster to a workers’ recovery professional, embracing concepts like claims advocacy, and focusing on a people-centric biopsychosocial model demonstrates a desire to make the claims process more human(e). It started as talk from conference stages but has gained traction at the supervisory and desk level over the past several years, especially as COVID forced everyone to reexamine their priorities.

A more recent lexicon change is to stop calling work comp an “industry” and start calling it an “ecosystem” where stakeholders work together as a team to accomplish the goal of RTW (return-to-work).

These changes in attitude and vernacular have gained momentum for one clear reason. The way work comp has been marketed to the rising generations is not appealing.

Some may say “marketing” is “spin,” but it is more about knowing your value then clearly, accurately and authentically broadcasting the message to those who it can benefit.

Every description of a claims adjuster from this point forward should start with the premise that they have a noble purpose.

Their role is to help a person (again, not a claimant) navigate potentially the most challenging time of their life and return to their job, income, colleagues, daily routine, and sense of self-worth and accomplishment as close to full health and function as quickly as possible. The competence of a claims adjuster can have a positive or negative effect on that person, their family, possibly generations. Competence means ensuring the right clinician is engaged at the right time, using empathetic communication to recognize red flags (like social determinants of health) that could slow progress, and encouraging the injured employee to be an active participant in their functional restoration.

The negative consequences of delayed recovery and return to their workplace compound every day so that person needs a guiding light to help them on that journey. The team that makes it happen is quarterbacked by the claims adjuster, someone whose value cannot be overstated.

Noble purpose. Noble purpose. Noble purpose. The more it’s said, the more it will be recognized as a reality.

*The views and opinions expressed in the Public Risk Management Association (PRIMA) blogs are those of each respective author. The views and opinions do not necessarily reflect the official policy or position of PRIMA.*

By: Mark Pew

Provost and Founding Partner, WorkCompCollege.com

Summary of Qualifications

Mark is an award-winning international speaker, author and jurisdictional advisor in workers’ compensation. The RxProfessor has focused on the intersection of chronic pain and appropriate treatment since 2003. Mark created “Qualified Medical Intervention” that won a 2012 Business Insurance Innovation Award. He received WorkCompCentral’s Magna Comp Laude award in 2016, IAIABC’s Samuel Gompers Award in 2017, “Top 100 Healthcare Leader” by IFAH in 2021 and the Health 2.0 Outstanding Leadership award in 2022. He is co-founder of The Transitions and is on the advisory boards of Harvard MedTech, Simple Therapy and Goldfinch Health.

Responsibilities

Mark is responsible for managing the ans and faculty and overseeing all curriculum and product development as provost. Given his role of long-time educator within the workers' compensation industry (over 670 presentations since 2012 to more than 65,000 people, hundreds of blogs and published articles, discussing important subjects before they become mainstream), this is the perfect application of his skills and passion. As one of the three founding partners of WorkCompCollege.com, he is also responsible for business management and strategy and is very active in sales and marketing activities.

Business Experience

Mark co-founded WorkCompCollege.com in 2022. He was senior VP of marketing & product development for Preferred Medical, a work comp PBM, from 2017 thru 2021. He led product development, sales and marketing at PRIUM, a work comp utilization management company, from 2000 thru 2017. He was a software developer, project manager , business analyst and department manager with Equifax / ChoicePoint from 1980 thru 2000.