April 17 | 12:00 pm – 1:00 pm EST

As artificial intelligence (AI) becomes a greater part of our professional lives, what does a public risk manager need to know to make the best decisions on how and when to utilize AI tools in the workplace? This webinar will look at ways to make AI work for you and your staff. We will also discuss the risk associated with utilizing AI tools, and how to identify the "sweet spot" where AI and human interaction work in tandem for maximum efficiencies and results. Finally, we will discuss ways to measure effectiveness and value of AI platforms.

Attendee Takeaways:

- Better understanding of how AI usage has revolutionized the public risk sector

- Discussion of some of the AI tools that are of value to the public risk sector

- Considerations (pros and cons) when introducing AI tools into the workplace

- Ways to measure value/ROI of AI tools

Sponsored by

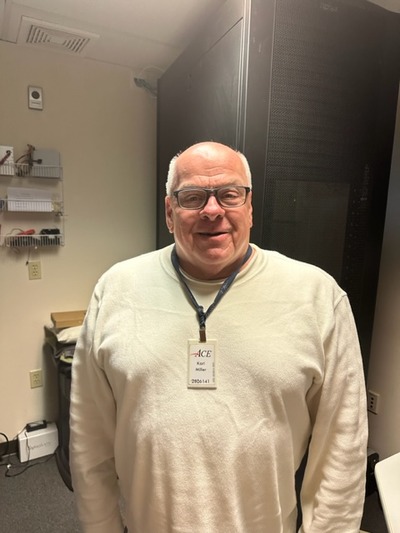

Presenter

Karl Miller, VP, Sales and Compliance, American Computer Estimating

Karl is a claims professional with three decades of experience overseeing implementation of products and services for over 200 insurance and public risk sector business partners nationwide. He is also responsible for ensuring legal compliance in claims handling and consulting on technological advances in the claims industry. He has spoken and been published on topics in the auto claims industry, including utilization of AI tools, diminished value and legal decisions affecting claims handling.

May 15 | 12:00 pm – 1:00 pm EST

The actuarial report may have many numbers and look pretty daunting, but with knowledge of some basic concepts, reading an actuarial report can actually be enjoyable. This session will not only provide attendees with a firm understanding of key actuarial results such as outstanding liabilities and projected funding rates, but also important actuarial concepts including loss development, inflationary trends, claim frequency and severity, reserve discounting, and confidence levels. Current industry trends will also be discussed.

Attendee Takeaways:

- Better understanding of actuarial concepts and results

- Ability to reasonably check the assumptions in the actuarial report

- Ability to use actuarial results to determine appropriate funding levels and claims trends

- Knowledge of current industry trends in various lines of business

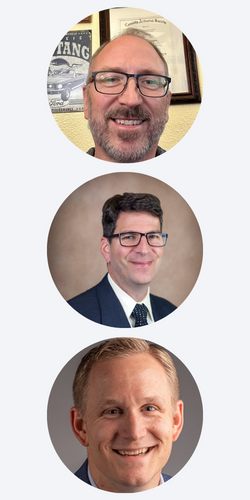

Presenters

Mike Harrington, FCAS, MAAA, Mark Priven, FCAS, MAAA & Stefan Zepernick, ACAS, MAAA

Mike is the president of Bickmore Actuarial and has over 25 years of experience in both the insurance industry and consulting, the majority of which is with public entities. He specializes in reserve and rate analysis for public entities and risk pools for all property and casualty coverages and is known for his informative and down-to-earth presentation style, with some good “actuarial humor” thrown in.

Prior to joining Bickmore, for five years Mark was vice president supporting retail brokerage clients at one of the largest international brokerage firms. He provided risk managers and brokers with loss forecasts, reserve studies, cost allocation plans, program comparisons, risk retentions analyses, benchmarking, price negotiations, and assisted in program design and feasibility studies for finite risk, captives, and self-insurance.

As a senior reserving analyst for one of California’s largest insurance companies, Mark was responsible for special studies of $1 billion in workers’ compensation reserves and claims handling costs. He also served as lead actuary supporting captives and franchise/association accounts.

With 10+ years of P&C insurance industry experience working as an actuary, product analyst and underwriter, Stefan has a strong understanding of how to balance actuarial data, business knowledge and market intelligence. He currently oversees seven lines of business for a farm and commercial agriculture insurance company, including commercial auto, commercial property, commercial umbrella, farm property, farm liability, farm umbrella and general liability. He also has prior experience in the pension industry performing actuarial analysis for California’s public employee pension system. Stefan earned his associate actuarial designation in 2016 and he is actively pursuing his Fellowship designation.

Mark holds a BA from the University of Pennsylvania. He also completed coursework at the University of Bristol.

June 26 | 12:00 pm – 1:00 pm EST

Risk mitigation involves trust in governance – trust from your risk partners that an issue is universally reviewed in fairness with integrity and will be managed with those same qualities. What happens when an issue is shrouded in misinformation or subterfuge? What happens when you rely on information provided that is not what it appears to be. This session focuses on managing the integrity of risk and its governance and learning how to let go of what you can’t control.

Attendee Takeaways:

- Understand the ethics of risk mitigation in governance.

- Learn communication strategies to overcome obstacles while identifying risk

- Learn to constructively accept the negative consequences of proactive risk mitigation

- Understand the chain of command’s responsibility in managing the totality of risk and its integrity

Presenter

Marilyn Rivers, CPCU, ARM, AIC, Principal, Rivers Risk Consulting, LLC

Marilyn is a nationally recognized public-private entity risk management professional and educator who has extensive experience in delivering program development, fiscal oversight, compliance and education tailored to meet the dynamic needs of business. She recently retired from public service with a combined 35 years of experience managing risk in both the public and private sectors. She holds a BS in chemistry from Clarkson and a Med from Tufts University. Her professional designations include the CPCU, ARM and AIC. Marilyn was the recipient of the PRIMA Risk Manager of the Year in 2007.

July 17 | 12:00 pm – 1:00 pm EST

More than ever, it is imperative that organizations establish a plan to ensure the resiliency of their most important asset: their people. This session is intended to provide attendees with the steps to identify (potential) gaps in their organization’s succession planning for both internal staff as well as their committees/board. Additionally, attendees will also be provided with a template form and other resources that are key to establishing an effective succession plan.

Attendee Takeaways:

- Understand the succession planning (SP) needs of their organization

- Identify areas of immediate need (between 0-5 years)

- Create a plan of action for both internal/external succession needs

Presenters

Mark Pew

Mark is an award-winning international speaker, author and jurisdictional advisor in workers’ compensation. The RxProfessor has focused on the intersection of chronic pain and appropriate treatment since 2003. Mark created “Qualified Medical Intervention” that won a 2012 Business Insurance Innovation Award. He received WorkCompCentral’s Magna Comp Laude award in 2016, IAIABC’s Samuel Gompers Award in 2017, “Top 100 Healthcare Leader” by IFAH in 2021 and the Health 2.0 Outstanding Leadership award in 2022. He is co-founder of The Transitions and is on the advisory boards of Harvard MedTech, Simple Therapy and Goldfinch Health.

August 21 | 12:00 pm – 1:00 pm EST

This program reviews the underlying reasons crashes occur and provides ideas you can use to minimize the potential for those incidents. The class also includes an overview of potential exposures, a discussion about entity responsibility, and options for developing an Action Plan to address potential weaknesses the participant identifies within their organization.

Attendee Takeaways:

- Discuss the underlying causes of crashes

- Demonstrate why, how, and when your organization should obtain Motor Vehicle Records (MVR)

- Apply MVR criteria and evaluation tactics when hiring potential drivers

- Interpret, measure and address risk driving behaviors within their own fleet

Presenter

Tiffany Allen, ARM-P, PS-MESH, Senior Territory Manager, Travelers

Tiffany has worked in the risk and insurance field for more than 30 years. She credits her understanding of insurance and risk management to her early career experience as an underwriter and more recent 14-year adventure in risk management for multiple government agencies in North Carolina. In 2014, Tiffany left her county family and joined an insurance family. From 2014-2020, Tiffany served as a senior risk control consultant for public sector services. Tiffany now serves as the territory manager for public sector services in the mid-Atlantic region. During Tiffany’s public sector career, she’s seen firsthand what a difference a robust fleet safety program can have on an organization’s experience.

September 25 | 12:00 pm – 1:00 pm EST

Authentic storytelling can help your organization build a connection with your citizens. Whether your goal is to raise awareness, change attitudes, or motivate action, storytelling is a powerful tactic to add to your communications strategy.

In this session, learn how taking a strategic approach toward storytelling can help you identify stories within your organization, tie them to your organizational goals, and develop them for various platforms and audiences.

Attendee Takeaways:

- Identifying how storytelling can help achieve your strategic communications goals

- Learn how to identify stories and develop them to interest, engage and inform your audiences

- Overview of the 5 C's of Storytelling

- Technical tips to put it all together

Presenter

Hollie Cammarasana, APR, MPA, Director of Communications, Virginia Risk Sharing Association

Hollie has served as the director of communications for the Virginia Risk Sharing Association since 2010. She has more than 20 years of experience in communications and public relations and has worked extensively with local, state and national media. Previously, Hollie worked in state government communications, as the public relations director for the Virginia Department of Housing and Community Development and as a public relations specialist for the Virginia Department of Social Services.

Hollie, who is accredited in public relations (APR), holds a bachelor’s degree in communications with a concentration in public relations and a minor in marketing from Virginia Commonwealth University, as well as a graduate certificate in public management and a master’s degree in public administration. Hollie has served on the board of the Public Relations Society of America – Richmond Chapter, and as a director at large for Virginia Government Communicators.

October 16 | 12:00 pm – 1:00 pm EST

Data drives decision-making in most institutions and can be a significant factor in how effective or ineffective an organization's enterprise risk management program can be. The University of Massachusetts will share how they are enhancing the quality and aggregation of data to inform their enterprise risk management program.

Attendee Takeaways:

- Learn how data from the ERM mitigation assessment tool MATRX is supporting ERM

- Learn how academic program, enrollment and admissions data is supporting decision making and risk mitigation

- Learn how to engage leadership about ERM data in a way that resonates

Presenter

Christine Packard, Assistant Vice President, Enterprise Risk Management, University of Massachusetts

Having spent more than 15 years in the field of emergency management, including seven as the deputy director of the Massachusetts Emergency Management Agency, Christine joined the University of Massachusetts in August 2019 as its first dedicated director of enterprise risk management. In her role as ERM Director, Christine is responsible for the system-wide enterprise risk management program, working with the five UMass campuses and the system office to identify and assess risk impacting the UMass system, and ensuring implementation of mitigation strategies.

November 20 | 12:00 pm – 1:00 pm EST

This webinar emphasizes the critical importance of fire safety in preserving lives and property. It provides statistical insight into fire incidents, highlighting their profound impact on communities. The event advocates for a collaborative approach, emphasizing the need for a coordinated effort between operational and preventive measures. The webinar covers various aspects, including conducting community risk assessments, implementing data-driven approaches for targeted risk identification, integrating operational and preventive efforts, showcasing successful case studies, addressing challenges and providing practical recommendations for implementation.

Attendee Takeaways:

- Gain a comprehensive understanding of fire safety's significance and its impact on communities, emphasizing a holistic perspective

- Learn about the benefits of a coordinated approach, integrating operational and preventive strategies for more effective risk identification and mitigation

- Explore case studies highlighting successful coordinated strategies and their positive outcomes in diverse community settings

- Acquire practical steps and resources for implementing coordinated strategies, addressing challenges, and contributing to measurable public and fire safety improvements

Presenter

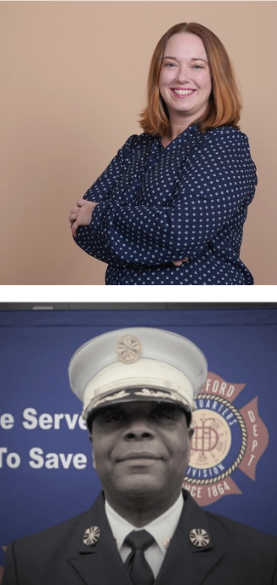

Sara Lowenthal, AINS, Director of Safety and Risk, City of Hartford, CT

Rodney Barco, Fire Chief, City of Hartford Fire Department

Sara has served as the director of safety & risk management for the City of Hartford for the last five years. During her tenure, she actively participated in the Uniformed Professional Fire Fighters Association of Connecticut’s (UPFFA of CT) Fire Ops program where she had the opportunity to experience what fire fighters deal with on a daily basis. This experience led her to become an advocate for firefighters and fire safety. Prior to her current role, she accumulated 20 years of experience working for insurance carriers Chubb, AIG and Starr in a variety of roles including accounting, claims, IT, operations, underwriting and vendor management. Sara is the treasurer of the CT Valley RIMS chapter and is a board member of the CT PRIMA chapter.

December 14 | 12:00 pm – 1:00 pm EST

As the technology landscape evolves, products and processes are becoming faster and more accessible. What about the partnerships to help secure our data in a continuously connected world? In this session, Kelvin will discuss resources and human-centric focus on best practices for implementing public and private sector partnerships to mitigate the risk of cyber threats.

Attendee Takeaways:

1. Learn how to identify key resources to address key issues

2. Learn best practices to facilitate public-private partnerships with regards to cybersecurity

Presenter

Kelvin Coleman, Partner, IBM Consulting

In career-spanning cybersecurity awareness tours in 49 states, Kelvin has briefed tech giants, local storeowners and politicians alike, including 35 governors and numerous state-level security committees. He is recognized for his work forging partnerships between the public and private sectors – developing cybersecurity policy and products, improving national and local cyber-threat awareness and readiness, and establishing guidelines for workforce cybersecurity safety. He has collaborated and worked closely with a variety of top government agencies, including the National Security Agency (NSA), Department of Defense (DoD), National Defense Information Sharing and Analysis Center (NDISAC) and internally with the Department of Homeland Security’s (DHS) Office of Cybersecurity and Communications.

January 18 | 12:00 pm – 1:00 pm EST

The cyber insurance has been in the midst of a hard market for two renewal cycles - pricing and coverage continuing to move in sine waves. The continued development of loss activity, the moving targets of security controls and the material wording changes has deepened the impact on insureds, with the potential of the hard market continuing for public entities who don't have required security controls in place. For the entities with the security controls, the market is starting to show signs of fragmentation. We will explore in detail the current marketplace asks for security controls, where the marketplace seems to be heading, as well as steps public entities can take to showcase themselves positively with the insurance marketplace.

Attendee Takeaways:

1. Understand where cyber insurance market is with regards to public entities

2. Understand security controls insurance underwriters are looking for help to obtain

3. How to continually have conversations with your insurance partners on your cyber security roadmap

4. How the industry is doing as a whole, are the insurers accurate in the statement that public entities are riskier than their private counterparts?

Presenter

Susan Leung, ARe, Vice President, Public Entity Group, Alliant Insurance Services, Inc.

Susan joined Alliant Insurance Services in 2018 and has been working with public entities since 2010. She has worked with many school and municipality pools across the country on general liability, professional liability, property and workers’ compensation placements, and has specific expertise in cyber insurance.

Currently, Susan is located in the Chicago office and serves as Alliant’s Public Entity Group Cyber Practice Leader. She has 18 years of insurance and reinsurance experience. In 2010, she began working with the public entity sector. She also spent a portion of her career in Asia leading cyber liability insurance placements for commercial entities across 13 countries.

Susan graduated with a Bachelor of Arts degree in finance from the University of Illinois at Urbana-Champaign. She obtained the Associate in Reinsurance designation in 2006.